B) False

Correct Answer

verified

Correct Answer

verified

True/False

The American opportunity credit and lifetime learning credit are available to all taxpayers regardless of their income level.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Individuals may file for and receive a six-month extension of time to file their tax return and pay their taxes without penalty.An extension does not extend the amount of time to pay the taxes due.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding late filing penalties and/or late payment penalties is true?

A) An extension of time to file the tax return protects a taxpayer from late payment penalties as long as the tax is paid by the extended due date of the return.

B) The penalty rate for late filing penalties is less than the penalty rate for late payment penalties.

C) If a taxpayer has not paid the full tax liability by the original due date of the return and the taxpayer has not filed a tax return by the due date of the return,the maximum late filing and late payment penalty will be no greater than the late filing penalty by itself.

D) None of these

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Katlyn reported $300 of net income from her sole proprietorship.She is not required to pay self-employment tax.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Long-term capital gains are taxed at the stated AMT rate for purposes of the alternative minimum tax.Long-term capital gains are taxed at preferential rates for AMT purposes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

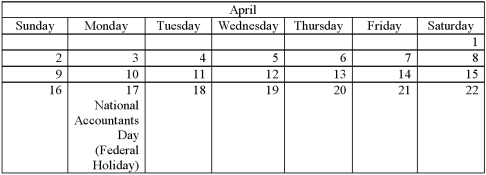

Looking at the following partial calendar for April,when will individual tax returns be due?

A) Friday,April 14

B) Saturday,April 15

C) Sunday,April 16

D) Monday,April 17

E) Tuesday,April 18

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The tax rate schedules are set up to tax lower levels of income at higher tax rates than higher levels of income.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

John and Sally pay Janet (Sally's older sister) to watch John and Sally's child Dexter during the day.Janet cares for Dexter in her home.John and Sally may claim a child and dependent care credit based on the amount they pay Janet to care for Dexter.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The amount of expenditures eligible for the child and dependent care credit is the least of three amounts.Which of the following is not one of those amounts?

A) The total amount of child and dependent care expenditures for the year

B) $3,000 for one qualifying person or $6,000 for two or more qualifying persons

C) The dependent's earned income for the year

D) The taxpayer's earned income for the year

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If there is not enough gross tax liability to use the foreign tax credit,__________.

A) it expires unused

B) it is carried back 2 years or forward 20 years

C) it is carried back 3 years or forward 5 years

D) it is carried back 1 year or forward 10 years

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Miley,a single taxpayer,plans on reporting $27,250 of taxable income this year (all of her income is from a part-time job) .She is considering applying for a second part-time job that would give her an additional $10,000 of taxable income.By how much will the income from the second job increase her tax liability (use the tax rate schedules) ?

A) $1,000

B) $1,500

C) $1,600

D) $2,500

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Asteria earned a $25,500 salary as an employee in 2013.How much should her employer have withheld from her paycheck for FICA taxes (rounded to the nearest whole dollar amount) ?

A) $370

B) $1,581

C) $1,951

D) $3,902

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

An 80-year-old taxpayer with earned income and no dependent children could qualify for the earned income credit.Taxpayers must be at least 25 years old and younger than 65 years old at the end of the year to claim the credit.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements regarding the child and dependent care credit is true?

A) A married couple must file jointly to claim the credit.

B) A taxpayer may claim a credit for dependent care expenses for a dependent who is 14 years old or older but only if the dependent lives in the taxpayer's home for the entire year.

C) All else equal,a taxpayer making qualifying expenditures for three children may claim more dependent care credit than a taxpayer making (the same amount of) qualifying expenditures for two children

D) None of these statements is true.Married taxpayers must file jointly and the credit is based on the income of the lesser-earning spouse.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If an employer withholds taxes from an employee,in general,when are these taxes treated as paid to the IRS?

A) As withheld

B) As the employee requests on his/her W-4 form

C) Evenly throughout the year

D) On April 15

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The alternative minimum tax base is typically ______ the regular income tax base.

A) smaller than

B) about the same as

C) larger than

D) exactly the same as

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not true of the extension to file an individual tax return?

A) It is granted automatically by the IRS if requested

B) It must be requested by the original due date of the return

C) It extends the due date for the return and associated tax payments beyond the original due date of the tax return

D) The extension is for six months beyond the original due date

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a barrier to income shifting among family members?

A) The assignment of income doctrine

B) Net unearned income for children 18 and younger taxed at parents' marginal tax rates

C) Elimination of preferential tax rates (on dividends and long-term capital gains) for dependents

D) Two of these

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a true statement about the American opportunity credit (AOC) and lifetime learning credits?

A) A taxpayer may not report both an AOC and a lifetime learning credit on the same tax return

B) Certain educational expenses qualify for both credits but taxpayers must claim one credit or the other for the expenditures (the taxpayer cannot claim both credits for the same expenditures)

C) Taxpayers may choose to either (1) deduct qualifying education expenses of an individual as for AGI deductions or claim educational credits for the individual's expenses (but not both)

D) The AGI phase-out threshold for phasing out the AOC is higher than the AGI phase-out threshold for the lifetime learning credit.A taxpayer may claim both credits on the same tax return but can't claim both credits for the same individual.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 132

Related Exams