A) Bond A will start falling

B) Bond B will start rising

C) Bond A was higher than that of Bond B

D) Bond A will start rising

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

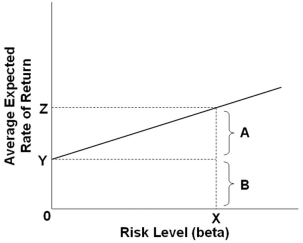

Refer to the graph above. The bracket A represents the:

Refer to the graph above. The bracket A represents the:

A) Rate of return for an asset

B) Rate of return for the risk-free asset

C) Risk premium for an asset with a certain risk level

D) Compensation for time preference for an asset with a certain risk level

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The buying and selling activities that tend to equalize the rates of return on identical or nearly identical assets is called:

A) Beta

B) Risk

C) Arbitrage

D) Diversification

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The so-called risk-free rate essentially measures the investors':

A) Risk aversion

B) Risk preference

C) Time preference

D) Expected rate of return

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements best describes the relationship between asset prices and average expected returns?

A) More risky assets will have similar prices as less risky assets

B) Less risky assets will have lower prices than more risky assets

C) Less risky assets will have higher prices than more risky assets

D) More risky assets will have higher prices than less risky assets

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Fed raises the interest rates on short-term U.S. government bonds, then the Security Market Line shifts:

A) Downward as the risk-free interest rate increases

B) Downward as the risk-free interest rate decreases

C) Upward as the risk-free interest rate increases

D) Upward as the risk-free interest rate decreases

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is true about investing in stocks and bonds?

A) Issuers of stocks can default on their stock obligations

B) Investing in stocks involve less risk because the future payments are less uncertain

C) In case of bankruptcy, bondholders get paid first ahead of stockholders

D) Bankruptcy occurs when the issuing firm is unable to fulfill its stock obligations

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The key difference between bonds and stocks is that stocks' income streams are more predictable than those of bonds.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The current price of an asset is equal to the future value of its expected returns or income streams.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The decision of the Federal Reserve to reduce the short-term interest rate will shift the Security Market Line upward.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Diversification is an investment strategy that seeks to reduce the overall risk in an investment portfolio by selecting a group of assets whose risks differ from one another.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The U.S. Federal government is unlikely to default on its bonds because:

A) The bonds are all long term bonds and they are insured

B) The Federal government has the ability to collect taxes and to sell securities to the Fed

C) Foreigners are willing to buy the Federal government bonds and lend to the U.S. government

D) The Federal government can always borrow from the states and from businesses

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Roger has the opportunity to invest $100,000 in two different assets. The investment in Asset #1 will have a present value of $120,000. The investment in Asset #2 is expected to have a future value of $140,000 in four years. If the market interest rate is 5 percent a year, which one would be the better investment?

A) Asset #2, because its future value is greater than the present value of Asset #1

B) Asset #1, because its present value is greater than the future value of Asset #2

C) Asset #2, because its present value is greater than the present value of Asset #1

D) Asset #1, because its present value is greater than the present value of Asset #2

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bond that pays no annual interest (or coupons) and has a face value at maturity will fetch a price today that is equal to the:

A) Future value of its face value

B) Number of years in the life of the bond times its face value

C) Present value of the number of years in the life of the bond times its face value

D) Present value of its face value

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Federal Reserve uses open-market operations to lower the interest rates on short-term U.S. government bonds, then as a consequence asset prices:

A) Increase, and the average expected rate of return on assets decreases

B) Decrease, and the average expected rate of return on assets increases

C) Increase, and the average expected rate of return on assets increases

D) Decrease, and the average expected rate of return on assets decreases

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The primary risk that bondholders face is that:

A) The bond will reduce in price

B) The bond issuer will default

C) Inflation will decrease

D) The rate of return will increase

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 121 - 136 of 136

Related Exams