B) False

Correct Answer

verified

Correct Answer

verified

Essay

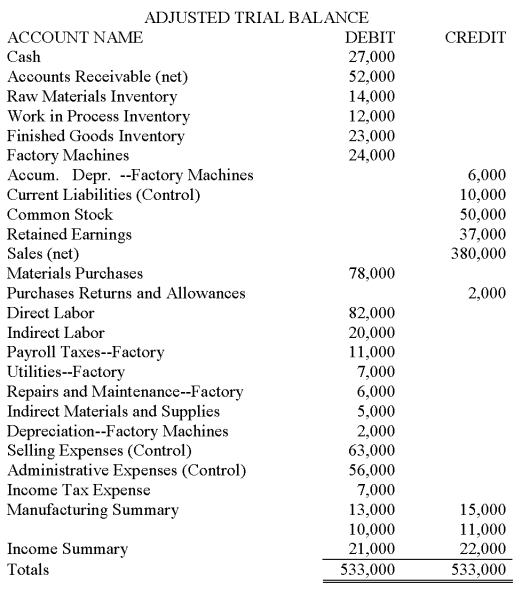

The accounts and the Adjusted Trial Balance section of Spencer Manufacturing's worksheet are given below.  Instructions:

(1) Enter the account names in the Account Name column and the adjusted trial balance in the Adjusted Trial Balance columns of a 12-column manufacturing worksheet. Or use a 10-column worksheet and use the last four columns, changing the column headings as needed.

(2) Extend the balances to the appropriate columns and complete the worksheet for the year ended December 31, 2013.

(3) Record the closing entries for all revenue and expense accounts and the Manufacturing Summary account on page 9 of a general journal. Omit descriptions.

Instructions:

(1) Enter the account names in the Account Name column and the adjusted trial balance in the Adjusted Trial Balance columns of a 12-column manufacturing worksheet. Or use a 10-column worksheet and use the last four columns, changing the column headings as needed.

(2) Extend the balances to the appropriate columns and complete the worksheet for the year ended December 31, 2013.

(3) Record the closing entries for all revenue and expense accounts and the Manufacturing Summary account on page 9 of a general journal. Omit descriptions.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Reversing entries are required by

A) the Internal Revenue Service.

B) Generally Accepted Accounting Principles.

C) the International Accounting Standards Board.

D) none of the above.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

If the ending finished goods inventory is greater than the beginning finished goods inventory, the cost of goods sold will be higher than the cost of goods manufactured.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

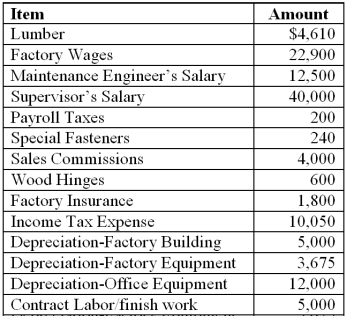

Using only the relevant items from the information given, determine the total product cost for Donnybrook Corporation, a manufacturer of children's furniture. All materials purchased were used in inventory during the current period. There was no beginning inventory.

Correct Answer

verified

Correct Answer

verified

True/False

The balance of the Manufacturing Summary account is closed into the Income Summary account.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Six adjusting entries are made for inventory accounts in a manufacturing operation.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

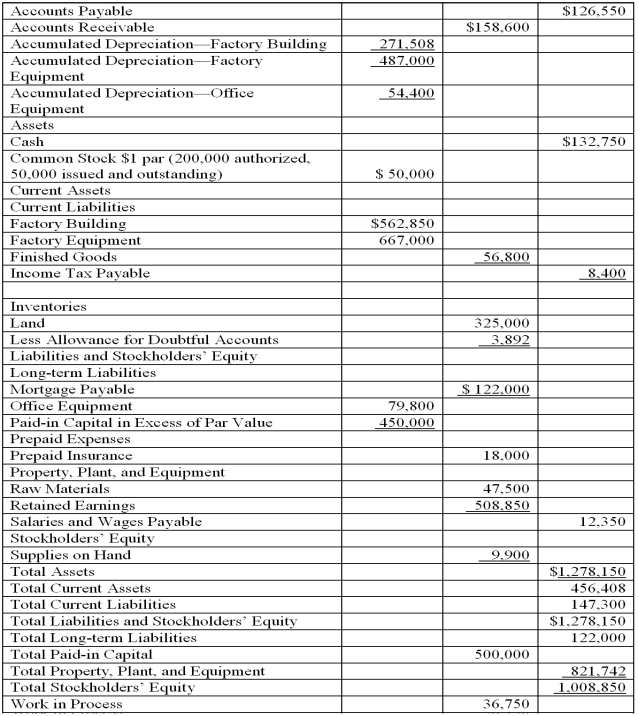

The Balance Sheet headings and the accounts and their balances for Exemplar Manufacturing are listed in alphabetical order. Exemplar Manufacturing has a fiscal year end of June 30, 2013.  -Using the information given, prepare the Balance Sheet for Exemplar Manufacturing. Include correct indentations, underlines, dates, and capitalization where needed.

-Using the information given, prepare the Balance Sheet for Exemplar Manufacturing. Include correct indentations, underlines, dates, and capitalization where needed.

Correct Answer

verified

Correct Answer

verified

True/False

Raw Materials Used is not an element of manufacturing overhead.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

What are the three inventory accounts for a manufacturing firm? List the three inventory accounts and indicate for each the name(s) of the statement(s) in which it appears.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Indirect Labor account is closed by crediting it and debiting

A) Wages Payable.

B) Income Summary.

C) Manufacturing Summary.

D) Wages Expense.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Short Answer

The beginning and ending ____________________ inventories appear in the Cost of Goods Sold section of the income statement of a manufacturing business.

Correct Answer

verified

Correct Answer

verified

Short Answer

For a manufacturing business, net sales minus cost of goods ____________________ equals gross profit on sales.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following information appears on the Statement of Cost of Goods Manufactured for the Coleman Company at the end of the year. The balance in Work in Process Inventory at year-end was:

A) $30,000.

B) $40,000.

C) $60,000.

D) $20,000. Ending Work in Process Inventory = 10,000 + 170,000 - 150,000 = 30,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Short Answer

The raw materials inventory is shown in the ____________________ section of the balance sheet of a manufacturing business.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The ending balance of the work in process inventory is recorded by debiting Work in Process Inventory and crediting

A) Income Summary.

B) Cost of Goods Sold.

C) Manufacturing Summary.

D) Merchandise Inventory.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In adjusting entries for a manufacturing business, the beginning balance of the work in process inventory is eliminated by crediting Work in Process Inventory and debiting

A) Finished Goods Inventory.

B) Manufacturing Summary.

C) Income Summary.

D) Merchandise Inventory.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The three components of total manufacturing cost are

A) cost of goods manufactured, cost of goods sold, and work in process.

B) raw materials used, direct labor, and manufacturing overhead.

C) selling expenses, administrative expenses, and manufacturing overhead.

D) raw materials used, direct labor, and cost of goods sold.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Short Answer

Bolton Company's total manufacturing cost for the year was $1,785,000. The firm's manufacturing overhead was $315,000, and its cost of raw materials used was $842,000. What was the direct labor cost for the year?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following information appears on the income statement of the Richer Company at the end of the year. Gross Profit on Sales was:

A) $140,000.

B) $160,000.

C) $200,000.

D) $220,000. Cost of Goods Sold = 200,000 + 120,000 - 180,000 = 140,000.

Gross Profit = 360,000 - 140,000 = 220,000.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 89

Related Exams