Correct Answer

verified

Correct Answer

verified

Multiple Choice

Numbers of times interest charges earned is computed as

A) Income before income taxes plus Interest Expense divided by Interest Expense

B) Income before income taxes less Interest Expense divided by Interest Expense

C) Income before income taxes divided by Interest Expense

D) Income before income taxes plus Interest Expense divided by Interest Revenue

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One potential advantage of financing corporations through the use of bonds rather than common stock is

A) the interest on bonds must be paid when due

B) the corporation must pay the bonds at maturity

C) the interest expense is deductible for tax purposes by the corporation

D) a higher earnings per share is guaranteed for existing common shareholders

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The market rate of interest is affected by a variety of factors, including investors' assessment of current economic conditions.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1, 2014, the Baker Corporation issued 10% bonds with a face value of $50,000. The bonds are sold for $46,000. The bonds pay interest semiannually on June 30 and December 31 and the maturity date is December 31, 2023. Baker records straight-line amortization of the bond discount. The bond interest expense for the year ended December 31, 2014, is

A) $5,000

B) $5,200

C) $5,800

D) $5,400

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The interest expense recorded on an interest payment date is increased

A) only if the market rate of interest is less than the stated rate of interest on that date.

B) by the amortization of premium on bonds payable.

C) by the amortization of discount on bonds payable.

D) only if the bonds were sold at face value.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The present value of the periodic bond interest payments is the value today of the amount of interest to be received at the at the end of each interest period.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the maturities of a bond issue are spread over several dates, the bonds are called

A) serial bonds

B) bearer bonds

C) debenture bonds

D) term bonds

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A legal document that indicates the name of the issuer, the face value of the bond and such other data is called

A) trading on the equity.

B) convertible bond.

C) a bond debenture.

D) a bond certificate.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The cash and securities comprising a sinking fund established to redeem bonds at maturity in 2015 should be classified on the balance sheet as

A) fixed assets

B) current assets

C) intangible assets

D) investments

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Gains and losses on the redemption of bonds are reported as other income or other expense on the income statement.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1, 2014, Gemstone Company obtained a $165,000, 10-year, 7% installment note from Guarantee Bank. The note requires annual payments of $23,492, with the first payment occurring on the last day of the fiscal year. The first payment consists of interest of $11,550 and principal repayment of $11,942. The journal entry to record the payment of the first annual amount due on the note would include:

A) a debit to cash of $11,942

B) a credit to Interest Payable of $11,550

C) a debit to Notes Payable of $11,942

D) a debit to Interest Expense of $23,492

F) None of the above

Correct Answer

verified

Correct Answer

verified

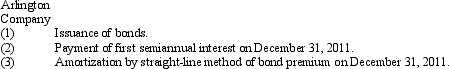

Essay

On June 30, 2011, Arlington Company issued $1,500,000 of 10-year, 8% bonds, dated June 30, for $1,540,000. Present entries to record the following transactions:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the market rate of interest is 10%, a $10,000, 12%, 10-year bond that pays interest semiannually would sell at an amount

A) less than face value.

B) equal to the face value.

C) greater than face value.

D) that cannot be determined.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bond indenture is

A) a contract between the corporation issuing the bonds and the underwriters selling the bonds

B) the amount due at the maturity date of the bonds

C) a contract between the corporation issuing the bonds and the bond trustee, who is acting on behalf of the bondholders.

D) the amount for which the corporation can buy back the bonds prior to the maturity date

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bonds Payable has a balance of $900,000 and Premium on Bonds Payable has a balance of $10,000. If the issuing corporation redeems the bonds at 103, what is the amount of gain or loss on redemption?

A) $1,200 loss

B) $1,200 gain

C) $17,000 loss

D) $17,000 gain

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Essay

On the first day of the fiscal year, a company issues a $1,000,000, 7%, 5 year bond that pays semi-annual interest of $35,000 ($1,000,000 × 7% × 1/2), receiving cash of $884,171. Journalize the entry to record the issuance of the bonds.

Correct Answer

verified

Correct Answer

verified

Essay

Prepare an amortization schedule for the 1st 2 years (straight line method) using the following data:

1. On January 1, 2010 XYZ Co. issued $3,000,000, 6%, 10 year bonds, interest payable on June 30th and December 31st to yield 5%. Use the following format and round to the nearest dollar (may have small rounding error). The bonds were issued for $3,233,834.

2. Show how this bond would be reported on the balance sheet on 12/31/11.

2. Show how this bond would be reported on the balance sheet on 12/31/11.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sinking Fund Investments would be classified on the balance sheet as

A) a current asset

B) a fixed asset

C) an investment

D) a deferred debit

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Bonds are sold at face value when the contract rate is equal to the market rate of interest.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 185

Related Exams