B) False

Correct Answer

verified

Correct Answer

verified

True/False

Obligations that may arise from past transactions only if certain events occur in the future are contingent liabilities.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following taxes are employers required to withhold from employees?

A) FICA tax

B) FICA tax and state and federal unemployment tax

C) state unemployment tax

D) federal unemployment tax

F) All of the above

Correct Answer

verified

Correct Answer

verified

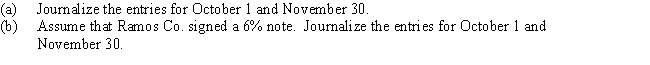

Essay

On October 1,Ramos Co.signed a $90,000,60-day discounted note at the bank.The discount rate was 6%,and the note was paid on November 30.

(Assume a 360-day year is used for interest calculations.)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each payroll item that follows to the one item (a-f) that best describes its characteristics. -FICA-Social security

A) Amount is limited, withheld from employee only

B) Amount is limited, withheld from employee and matched by employer

C) Amount is limited, paid by employer only

D) Amount is not limited, withheld from employee only

E) Amount is not limited, withheld from employee and matched by employer

F) Amount is not limited, paid by employer only

H) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Martinez Co.borrowed $50,000 on March 1 of the current year by signing a 60-day,9%,interest-bearing note.Assuming a 360-day year,when the note is paid on April 30,the entry to record the payment should include a

A) debit to Interest Payable for $750

B) debit to Interest Expense for $750

C) credit to Cash for $50,000

D) credit to Cash for $54,500

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

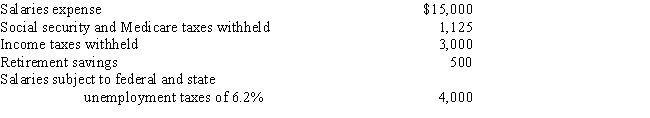

Use this information for Magnum Company to answer the following questions.

The following totals for the month of April were taken from the payroll register of Magnum Company:

-The journal entry to record the monthly payroll on April 30 would include a

-The journal entry to record the monthly payroll on April 30 would include a

A) credit to Salaries Payable for $8,150

B) debit to Salaries Expense for $7,902

C) debit to Salaries Payable for $8,150

D) debit to Salaries Payable for $7,902

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The journal entry to record the issuance of a note for the purpose of converting an existing account payable would be

A) debit Cash; credit Accounts Payable

B) debit Accounts Payable; credit Cash

C) debit Cash; credit Notes Payable

D) debit Accounts Payable; credit Notes Payable

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

During the first year of operations,a company granted warranties on its products at an estimated cost of $8,500.The product warranty expense should be recorded in the years of the expenditures to repair the products covered by the warranty payments.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On June 1,Davis Inc.issued an $84,000,5%,120-day note payable to Garcia Company.Assume that the fiscal year of Garcia ends June 30.Using the 360-day year,what is the amount of interest revenue (rounded) recognized by Garcia in the following year?

A) $700

B) $1,600

C) $1,062

D) $4,200

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The journal entry a company uses to record partially funded pension rights for its salaried employees at the end of the year is

A) debit Salaries Expense; credit Cash

B) debit Pension Expense; credit Unfunded Pension Liability

C) debit Pension Expense; credit Unfunded Pension Liability and Cash

D) debit Pension Expense; credit Cash

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following key (a-d) to identify the proper treatment of each contingent liability. -Event is probable and amount is estimable

A) Record only

B) Record and disclose

C) Disclose only

D) Do not record or disclose

![]()

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following totals for the month of June were taken from the payroll register of Young Company:  The entry to record the accrual of the employer's payroll taxes would include a debit to

The entry to record the accrual of the employer's payroll taxes would include a debit to

A) Payroll Tax Expense for $2,498

B) Social Security and Medicare Tax Payable for $2,250

C) Payroll Tax Expense for $1,373

D) Payroll Tax Expense for $3,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a borrower receives the face amount of a discounted note less the discount,the amount is known as the

A) note proceeds

B) note discount

C) note deferred interest

D) note principal

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Current liabilities are due

A) but not receivable for more than one year

B) but not payable for more than one year

C) and receivable within one year

D) and payable within one year

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The accounting for defined benefit plans is usually very easy and straightforward.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Federal unemployment compensation tax becomes an employer's liability at the time the employee is paid.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The total earnings of an employee for a payroll period is referred to as

A) take-home pay

B) pay net of taxes

C) net pay

D) gross pay

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following key (a-d) to identify the proper treatment of each contingent liability. -Event is remote and amount is estimable

A) Record only

B) Record and disclose

C) Disclose only

D) Do not record or disclose

![]()

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Payroll taxes are based on the employee's net pay.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 197

Related Exams