A) Solvency

B) Leverage

C) Times interest earned

D) Horizontal analysis

E) Vertical analysis

F) Common-sized financial statements

G) Current position analysis

H) Profitability analysis

J) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Corporate annual reports typically do not contain

A) management discussion and analysis

B) an SEC statement expressing an opinion

C) accompanying notes

D) an auditor's report

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The report on internal control required by the Sarbanes-Oxley Act of 2002 may be prepared by either management or the company's auditors.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

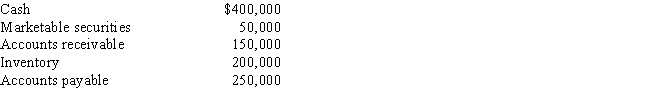

The following items are reported on a company's balance sheet:  Determine the

(a)current ratio,and

(b)quick ratio.Round your answers to one decimal place.

Determine the

(a)current ratio,and

(b)quick ratio.Round your answers to one decimal place.

Correct Answer

verified

Correct Answer

verified

True/False

The dividend yield is equal to the dividends per share divided by the par value per share of common stock.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

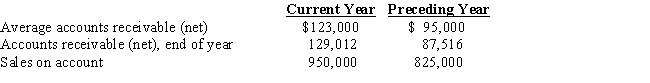

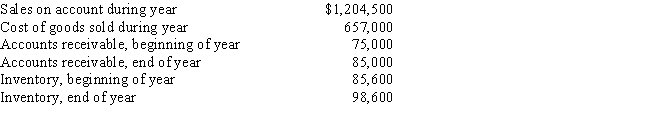

The following data are taken from the financial statements:

Correct Answer

verified

Correct Answer

verified

True/False

The number of days' sales in inventory is one means of expressing the relationship between the cost of goods sold and inventory.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

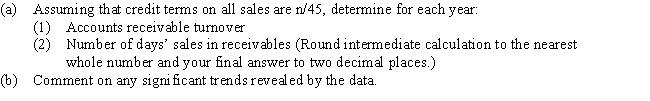

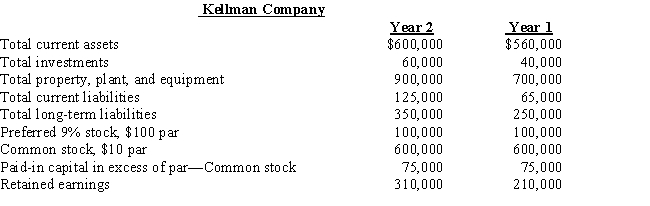

Use this information for Kellman Company to answer the questions that follow.

The balance sheets at the end of each of the first two years of operations indicate the following:

-Using the balance sheets for Kellman Company,if net income is $150,000 and interest expense is $20,000 for Year 2,what is the return on total assets for the year?

-Using the balance sheets for Kellman Company,if net income is $150,000 and interest expense is $20,000 for Year 2,what is the return on total assets for the year?

A) 10.4%

B) 11.9%

C) 10.5%

D) 8.4%

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

An unusual item is often related to current operations and occurs infrequently.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Ratios and various other analytical measures are not a substitute for sound judgment,nor do they provide definitive guides for action.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each ratio that follows to its use (items a-h) . Items may be used more than once. -Asset turnover ratio

A) Assess the profitability of the assets

B) Assess how effectively assets are used

C) Indicate the ability to pay current liabilities

D) Indicate how much of the company is financed by debt and equity

E) Indicate instant debt-paying ability

F) Assess the profitability of the investment by common stockholders

G) Indicate future earnings prospects

H) Indicate the extent to which earnings are being distributed to common stockholders

J) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

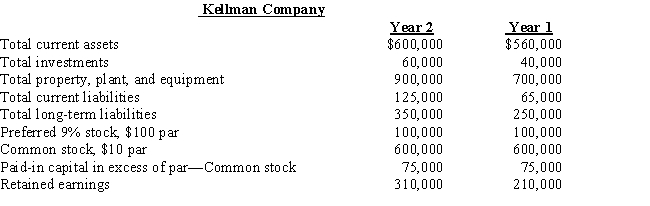

Use this information for Kellman Company to answer the questions that follow.

The balance sheets at the end of each of the first two years of operations indicate the following:

-Using the balance sheets for Kellman Company,if net income is $250,000 and interest expense is $20,000 for Year 2,and the market price of common shares is $30,what is the price-earnings ratio on common stock for Year 2? (Round intermediate calculation to two decimal places and final answers to one decimal place.)

-Using the balance sheets for Kellman Company,if net income is $250,000 and interest expense is $20,000 for Year 2,and the market price of common shares is $30,what is the price-earnings ratio on common stock for Year 2? (Round intermediate calculation to two decimal places and final answers to one decimal place.)

A) 7.5

B) 13.4

C) 12.1

D) 8.5

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Percentage analyses,ratios,turnovers,and other measures of financial position and operating results are

A) a substitute for sound judgment

B) useful analytical measures

C) enough information for analysis; industry information is not needed

D) unnecessary for analysis if industry information is available

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Horizontal analysis of comparative financial statements includes

A) development of common-sized statements

B) calculation of liquidity ratios

C) calculation of dollar amount changes and percentage changes from the previous to the current year

D) evaluation of each component in a financial statement to a total within the statement

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Based on the following data for the current year,what is the number of days' sales in inventory?

A) 51.2

B) 44.4

C) 6.5

D) 7.5

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each ratio that follows to its use (items a-h) . Items may be used more than once. -Working capital

A) Assess the profitability of the assets

B) Assess how effectively assets are used

C) Indicate the ability to pay current liabilities

D) Indicate how much of the company is financed by debt and equity

E) Indicate instant debt-paying ability

F) Assess the profitability of the investment by common stockholders

G) Indicate future earnings prospects

H) Indicate the extent to which earnings are being distributed to common stockholders

J) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following ratios provides a solvency measure that shows the margin of safety of bondholders and also gives an indication of the potential ability of the business to borrow additional funds on a long-term basis?

A) ratio of fixed assets to long-term liabilities

B) asset turnover ratio

C) number of days' sales in receivables

D) return on stockholders' equity

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

When a corporation discontinues a segment of its operations at a loss,the loss should be reported as a separate item after income from continuing operations on the income statement.

B) False

Correct Answer

verified

Correct Answer

verified

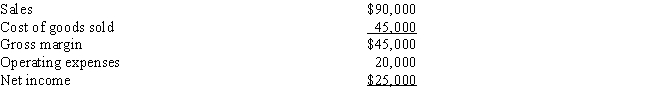

Multiple Choice

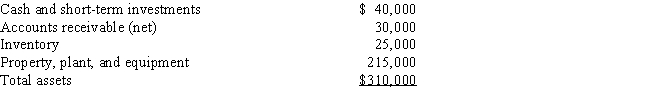

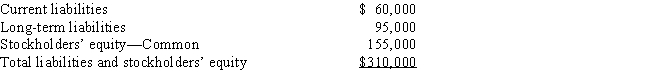

The following information pertains to Newman Company.Assume that all balance sheet amounts represent both average and ending balance figures and that all sales were on credit.Assets  Liabilities and Stockholders' Equity

Liabilities and Stockholders' Equity  Income Statement

Income Statement

What is the return on total assets for this company?

What is the return on total assets for this company?

A) 8.1%

B) 6.8%

C) 10.5%

D) 16.1%

F) B) and D)

Correct Answer

verified

Correct Answer

verified

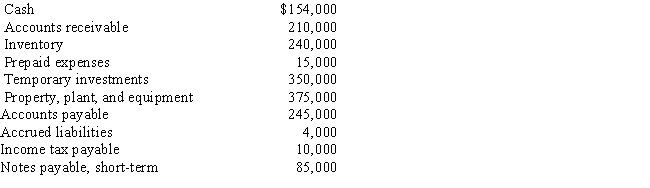

Essay

The following data are taken from the balance sheet at the end of the current year:  Determine the

(a)working capital,

(b)current ratio,and

(c)quick ratio.Round ratios to one decimal place.

Determine the

(a)working capital,

(b)current ratio,and

(c)quick ratio.Round ratios to one decimal place.

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 200

Related Exams