A) $40,000

B) $40,400

C) $43,600

D) $44,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

A company is selling its receivables when it issues its own credit card.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The accounts receivable turnover measures the length of time in days it takes to collect a receivable.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each description to the appropriate term (a-i) . -A receivable created from selling merchandise or services on account

A) Accounts receivable turnover

B) Net realizable value

C) Accounts receivable

D) Aging the receivables

E) Receivables

F) Direct write-off method

G) Allowance for doubtful accounts

H) Bad debt expense

I) Notes receivable

K) B) and I)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Allowance for Doubtful Accounts has a debit balance of $1,100 at the end of the year (before adjustment) ,and an analysis of customers' accounts indicates uncollectible receivables of $12,900.Which of the following entries records the proper adjustment for bad debt expense?

A) debit Bad Debt Expense, $14,000; credit Allowance for Doubtful Accounts, $14,000

B) debit Allowance for Doubtful Accounts, $14,000; credit Bad Debt Expense, $14,000

C) debit Allowance for Doubtful Accounts, $11,800; credit Bad Debt Expense, $11,800

D) debit Bad Debt Expense, $11,800; credit Allowance for Doubtful Accounts, $11,800

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

At the end of a period (before adjustment),Allowance for Doubtful Accounts has a credit balance of $250.The credit sales for the period total $500,000.If the company estimates uncollectible accounts expense at 1% of credit sales,the amount of bad debt expense to be recorded in an adjusting entry is $4,750.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The accounts receivable turnover ratio is computed by dividing total gross sales by the average net receivables during the year.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The maturity value of a 12%,60-day note for $5,000 is $5,600.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The journal entry to record a note received from a customer to replace an account is

A) debit Notes Receivable; credit Accounts Receivable

B) debit Accounts Receivable; credit Notes Receivable

C) debit Cash; credit Notes Receivable

D) debit Notes Receivable; credit Notes Payable

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An alternative name for Bad Debt Expense is

A) Collection Expense

B) Credit Loss Expense

C) Uncollectible Accounts Expense

D) Deadbeat Expense

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which statement is not true?

A) Current assets are normally reported in order of their liquidity.

B) Disclosures related to receivables are reported in the financial statement notes.

C) Cash and cash equivalents are the first items reported under Current assets.

D) All receivables that are expected to be realized in cash beyond 265 days are reported in the Noncurrent assets section.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A $6,000,60-day,12% note recorded on November 21 is not paid by the maker at maturity.The journal entry to recognize this event is

A) debit Cash, $6,120; credit Notes Receivable, $6,120

B) debit Accounts Receivable, $6,120; credit Notes Receivable, $6,000; credit Interest Receivable, $120

C) debit Notes Receivable, $6,060; credit Accounts Receivable, $6,060

D) debit Accounts Receivable, $6,120; credit Notes Receivable, $6,000; credit Interest Revenue, $120

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The equation for computing interest on an interest-bearing note is as follows: Interest = Maturity Value × Interest Rate × Time.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each description to the appropriate term (a-h) . -The amount charged for using the money of another party

A) Face amount

B) Term

C) Interest

D) Maturity value

E) Dishonored note

F) Maker

G) Notes receivable

H) Interest rate

J) A) and F)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under the allowance method,when a year-end adjustment is made for estimated uncollectible accounts

A) liabilities decrease

B) net income is unchanged

C) total assets are unchanged

D) total assets decrease

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a company uses the allowance method of accounting for uncollectible receivables,which entry would not be found in the general journal?

A) Bad Debt Expense 500Allowance for Doubtful Accounts 500

B) Bad Debt Expense 500Accounts Receivable-Bob Smith 500

C) Cash 300Allowance for Doubtful Accounts 200Accounts Receivable-Bob Smith 500

D) Cash 500Accounts Receivable-Bob Smith 500

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The operating expense recorded from uncollectible receivables can be called all of the following except

A) Accounts Receivable

B) Bad Debt Expense

C) Doubtful Accounts Expense

D) Uncollectible Accounts Expense

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A 60-day,12% note for $7,000,dated April 15,is received from a customer on account.The face value of the note is

A) $6,860

B) $7,140

C) $7,840

D) $7,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Essay

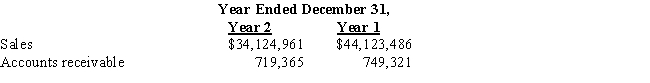

For fiscal Year 1 and Year 2,Grange Co.reported the following:  (a) Compute the accounts receivable turnover for Year 2.Round to two decimal places.

(b) Compute the days' sales in receivables at the end of Year 2.Round to two decimal places.

(a) Compute the accounts receivable turnover for Year 2.Round to two decimal places.

(b) Compute the days' sales in receivables at the end of Year 2.Round to two decimal places.

Correct Answer

verified

Correct Answer

verified

True/False

The maturity value of a note receivable is always the same as its face value.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 192

Related Exams