A) $400

B) $650

C) $350

D) $820

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

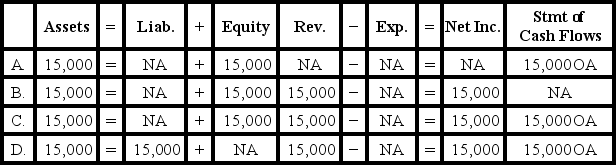

Frank Company earned $15,000 of cash revenue.Which of the following accurately reflects how this event affects the company's financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dividends paid by a company are reported on which of the following financial statement(s) ?

A) Income statement

B) Statement of changes in stockholders' equity

C) Statement of cash flows

D) Statement of changes in stockholders' equity and statement of cash flows

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following groups has the primary responsibility for establishing generally accepted accounting principles for business entities in the United States?

A) Securities and Exchange Commission

B) U.S.Congress

C) International Accounting Standards Board

D) Financial Accounting Standards Board

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following information applies to the questions displayed below. Yowell Company began operations on January 1, Year 1. During Year 1, the company engaged in the following cash transactions: 1) issued stock for $40,000 2) borrowed $25,000 from its bank 3) provided consulting services for $39,000 4) paid back $15,000 of the bank loan 5) paid rent expense for $9,000 6) purchased equipment costing $12,000 7) paid $3,000 dividends to stockholders 8) paid employees' salaries, $21,000 -What is Yowell's net cash flow from operating activities?

A) Inflow of $6,000

B) Inflow of $9,000

C) Inflow of $18,000

D) Inflow of $30,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Financial accounting standards are known collectively as GAAP.What does that acronym stand for?

A) Generally Accepted Accounting Principles

B) Generally Applied Accounting Procedures

C) Governmentally Approved Accounting Practices

D) Generally Authorized Auditing Principles

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be reported in the cash flow from financing activities section of a statement of cash flows?

A) Paid cash for dividends

B) Received cash for common stock

C) Sold land for cash

D) Paying cash for dividends and receiving cash from common stock

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following information applies to the questions displayed below The financial statements of Calloway Company prepared at the end of the current year contained the following elements and corresponding amounts: Assets = $50,000; Liabilities = ?; Common Stock = $15,000; Revenue = $22,000; Dividends = $1,500; Beginning Retained Earnings = $3,500; Ending Retained Earnings = $7,500. -Based on this information,what was the amount of expenses reported on Calloway's income statement for the current year?

A) $18,500

B) $13,000

C) $16,500

D) $10,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The stockholders of a business have a priority claim to its assets in the event of liquidation.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The types of resources needed by a business are financial,physical,and labor resources.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At the time of liquidation,Fairchild Company reported assets of $200,000,liabilities of $120,000,common stock of $70,000 and retained earnings of $10,000) .What is the maximum amount of Fairchild's assets that the shareholders are entitled to receive?

A) $200,000

B) $80,000

C) $90,000

D) $100,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

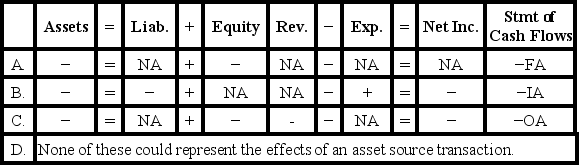

Which of the following describes the effects of an asset use transaction on the elements of a company's financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

F) C) and D)

Correct Answer

verified

Correct Answer

verified

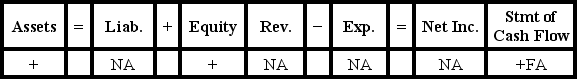

Multiple Choice

Chico Company experienced an accounting event that affected its financial statements as indicated below:

Which of the following accounting events could have caused these effects on the elements of Chico's financial statements?

Which of the following accounting events could have caused these effects on the elements of Chico's financial statements?

A) Issued common stock

B) Earned cash revenue

C) Borrowed money from a bank

D) Paid a cash dividend

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following information applies to the questions displayed below Packard Company engaged in the following transactions during Year 1, its first year of operations: (Assume all transactions are cash transactions.) 1) Acquired $950 cash from the issue of common stock. 2) Borrowed $420 from a bank. 3) Earned $650 of revenues. 4) Paid expenses of $250. 5) Paid a $50 dividend. During Year 2, Packard engaged in the following transactions: (Assume all transactions are cash transactions.) 1) Issued an additional $325 of common stock. 2) Repaid $220 of its debt to the bank. 3) Earned revenues of $750. 4) Incurred expenses of $360. 5) Paid dividends of $100. -What is the amount of total stockholders' equity that will be reported on Packard's balance sheet at the end of Year 1?

A) $1,350

B) $900

C) $250

D) $1,300

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which resource providers lend financial resources to a business with the expectation of repayment with interest?

A) Consumers

B) Creditors

C) Investors

D) Owners

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The financial statements of Calloway Company prepared at the end of the current year contained the following elements and corresponding amounts: Assets = $50,000; Liabilities = ?; Common Stock = $15,000; Revenue = $22,000; Dividends = $1,500; Beginning Retained Earnings = $3,500; Ending Retained Earnings = $7,500. -What was the amount of total liabilities reported on the balance sheet as of the end of the current year?

A) $27,500

B) $31,500

C) $35,000

D) $42,500

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Heritage Company is a manufacturer of office furniture.Which term best describes Heritage's role in society?

A) Conversion agent

B) Regulatory agency

C) Consumer

D) Resource owner

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The four financial statements prepared by a business bear no relationship to each other.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Chow Company earned $1,500 of cash revenue,paid $1,200 for cash expenses,and paid a $200 cash dividend to its owners.Which of the following statements is true?

A) The net cash inflow from operating activities was $100.

B) The net cash outflow for investing activities was $200.

C) The net cash inflow from operating activities was $300.

D) The net cash outflow for investing activities was $100.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not an element of the financial statements?

A) Net income

B) Revenue

C) Assets

D) Cash

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 94

Related Exams