Correct Answer

verified

Correct Answer

verified

Multiple Choice

Excom sells radios and each unit carries a two-year replacement warranty.The cost of repair defects under the warranty is estimated at 5% of the sales price.During September,Excom sells 100 radios for $50 each.One radio is actually replaced during September.For what amount in September would Excom debit Product Warranty Expense?

A) $50

B) $250

C) $30

D) $120

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Federal income taxes are subject to a maximum amount per employee per year.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assuming a 360-day year,proceeds of $48,750 were received from discounting a $50,000,90-day note at a bank.The discount rate used by the bank in computing the proceeds was

A) 6.25%

B) 10.00%

C) 10.26%

D) 9.75%

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Year 1,Zero Company obtained a $52,000,4-year,6.5% installment note from Regional Bank.The note requires annual payments of $15,179,beginning on December 31,Year 1.The December 31,Year 3 carrying amount in the allocation of periodic payments table for this installment note will be equal to

A) $0

B) $13,000

C) $14,252

D) $6,463

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The journal entry used to record the issuance of a discounted note for the purpose of borrowing funds for the business is

A) debit Cash and Interest Expense; credit Notes Payable

B) debit Cash and Interest Payable; credit Notes Payable

C) debit Accounts Payable; credit Notes Payable

D) debit Notes Payable; credit Cash

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

One of the more popular defined contribution plans is the 401k plan.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Vacation pay payable is reported on the balance sheet as a(n)

A) current liability or long-term liability,depending upon when the vacations will be taken by employees

B) current liability

C) expense

D) long-term liability

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1,Year 1,Zero Company obtained a $52,000,4-year,6.5% installment note from Regional Bank.The note requires annual payments of $15,179,beginning on December 31,Year 1.The December 31,Year 2 carrying amount in the allocation of periodic payments table for this installment note will be equal to

A) $26,000

B) $27,635

C) $21,642

D) $28,402

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following are included in the employer's payroll taxes?

A) SUTA taxes

B) FUTA taxes

C) social security taxes

D) all are included in employer taxes

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Estimating and recording product warranty expense in the period of the sale best follows the

A) cost concept

B) business entity concept

C) matching concept

D) materiality concept

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match the following terms or phrases in (a-g) with the explanations in 1-8.Terms or phrases may be used more than once. -Cash + Temporary investments + Accounts receivable

A) Current ratio

B) Working capital

C) Quick assets

D) Quick ratio

E) Record an accrual and disclose in the notes to the financial statements

F) Disclose only in notes to financial statements

G) No disclosure needed in notes to financial statements

![]()

I) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Based on the following data,what is the quick ratio,rounded to one decimal point?

A) 3.4

B) 3.0

C) 2.2

D) 1.8

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Essay

The summary of the payroll for the monthly pay period ending July 15 indicated the following:

Journalize the entries to record (a)the payroll and (b)the employer's payroll tax expense for the month.The state unemployment tax rate is 3.1%,and the federal unemployment tax rate is 0.8%.Only $25,000 of salaries are subject to unemployment taxes.

Journalize the entries to record (a)the payroll and (b)the employer's payroll tax expense for the month.The state unemployment tax rate is 3.1%,and the federal unemployment tax rate is 0.8%.Only $25,000 of salaries are subject to unemployment taxes.

Correct Answer

verified

Correct Answer

verified

Essay

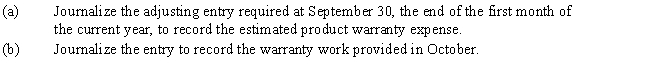

Nelson Industries warrants its products for one year.The estimated product warranty is 4.3% of sales.Sales were $475,000 for September.In October,a customer received warranty repairs requiring $215 of parts and $65 of labor.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wright Company sells merchandise with a one-year warranty.This year,sales consisted of 2,000 units.It is estimated that warranty repairs will average $15 per unit sold,and 30% of the repairs will be made this year and 70% next year.In this year's income statement,Wright should show warranty expense of

A) $9,000

B) $21,000

C) $30,000

D) $0

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to a summary of the payroll of Scotland Company,total salaries were $500,000.Assume that social security taxes are payable at a 6% rate and Medicare taxes are payable at a 1.5% rate with no maximum earnings.Federal income tax withheld was $98,000.Also,$15,000 was subject to state (4.2%) and federal (0.8%) unemployment taxes.The journal entry to record accrued salaries would include a

A) debit to Salaries Payable of $365,250

B) credit to Salaries Payable of $364,500

C) debit to Salaries Expense of $364,500

D) credit to Salaries Expense of $365,250

F) A) and B)

Correct Answer

verified

Correct Answer

verified

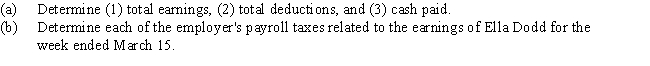

Essay

The following information is for employee Ella Dodd for the week ended March 15.

Total hours worked: 48

Rate: $15 per hour,with double time for all hours in excess of 40

Federal income tax withheld: $200

United Fund deduction: $50

Cumulative earnings prior to current week: $6,400

Tax rates:

Social security: 6% with no maximum earnings.

Medicare tax: 1.5% on all earnings.

State unemployment: 3.4% with no maximum earnings; on employer

Federal unemployment: 0.8% with no maximum earnings; on employer

Correct Answer

verified

Correct Answer

verified

True/False

FICA tax is a payroll tax that is paid only by employers.

B) False

Correct Answer

verified

Correct Answer

verified

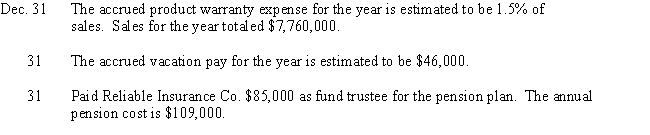

Essay

Journalize the following transactions:

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 188

Related Exams