B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

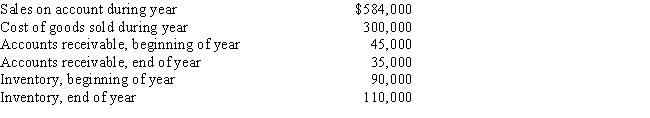

Based on the following data for the current year,what is the number of days' sales in receivables?

A) 7.3

B) 2.5

C) 14.6

D) 25

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The percentage analysis of increases and decreases in individual items in comparative financial statements is called

A) vertical analysis

B) solvency analysis

C) profitability analysis

D) horizontal analysis

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

In the vertical analysis of an income statement,each item is generally stated as a percentage of total assets.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following items should be classified as an unusual item on an income statement?

A) gain on the retirement of a bond payable

B) gain on a sale of a long-term investment

C) loss due to a discontinued operation in Colorado

D) selling treasury stock for more than the company paid for it

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Assuming that the quantities of inventory on hand during the current year were sufficient to meet all demands for sales,a decrease in the inventory turnover for the current year when compared with the turnover for the preceding year indicates an improvement in inventory management.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

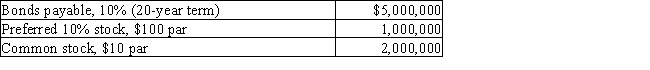

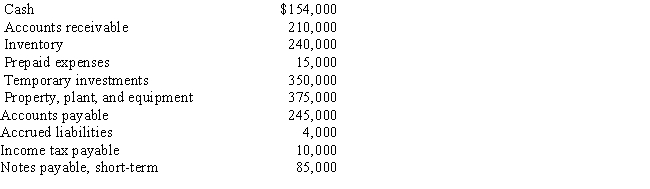

The balance sheet for Seuss Company at the end of the current fiscal year indicated the following:

Income before income tax was $1,500,000 and income taxes were $200,000 for the current year.Cash dividends paid on common stock during the current year totaled $150,000.The common stock sells for $75 per share at the end of the year.

Determine each of the following:

Income before income tax was $1,500,000 and income taxes were $200,000 for the current year.Cash dividends paid on common stock during the current year totaled $150,000.The common stock sells for $75 per share at the end of the year.

Determine each of the following:

Round to one decimal place except earnings per share and dividends per share,which should be rounded to two decimal places.

Round to one decimal place except earnings per share and dividends per share,which should be rounded to two decimal places.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Horizontal analysis is a technique for evaluating financial statement data

A) for one period of time

B) over a period of time

C) on a certain date

D) as it may appear in the future

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hsu Company reported the following on its income statement:

Interest expense was $80,000.Hsu Company's times interest earned ratio is

Interest expense was $80,000.Hsu Company's times interest earned ratio is

A) 8 times

B) 6.25 times

C) 5.25 times

D) 5 times

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Comparing dividends per share to earnings per share indicates the extent to which the corporation is retaining its earnings for use in operations.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

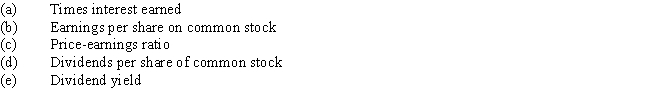

Match each ratio that follows to its use (items a-h) .Items may be used more than once. -dividends per share

A) assess the profitability of the assets

B) assess how effectively assets are used

C) indicate the ability to pay current liabilities

D) indicate how much of the company is financed by debt and equity

E) indicate instant debt-paying ability

F) assess the profitability of the investment by common stockholders

G) indicate future earnings prospects

H) indicate the extent to which earnings are being distributed to common stockholders

![]()

J) E) and H)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a common-sized income statement,100% is the

A) net cost of goods sold

B) net income

C) gross profit

D) sales

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Solvency analysis focuses on the ability of a business to pay its current and noncurrent liabilities.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

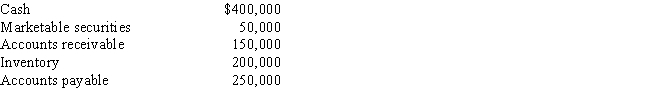

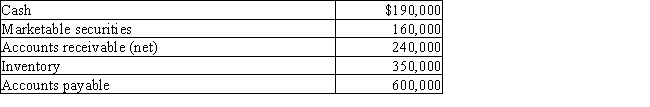

The following items are reported on a company's balance sheet:

Determine the (a)current ratio,and (b)quick ratio.Round your answer to one decimal place.

Determine the (a)current ratio,and (b)quick ratio.Round your answer to one decimal place.

Correct Answer

verified

Correct Answer

verified

Essay

The following data are taken from the balance sheet at the end of the current year.

Determine the (a)working capital,(b)current ratio,and (c)quick ratio.Round ratios to one decimal place.

Determine the (a)working capital,(b)current ratio,and (c)quick ratio.Round ratios to one decimal place.

Correct Answer

verified

Correct Answer

verified

Essay

The following items are reported on Denver Company's balance sheet:

Determine (a)the current ratio and (b)the quick ratio.Round to one decimal place.

Determine (a)the current ratio and (b)the quick ratio.Round to one decimal place.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An acceleration in the collection of receivables will tend to cause the accounts receivable turnover to

A) decrease

B) remain the same

C) either increase or decrease

D) increase

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Leverage implies that a company

A) contains debt financing

B) contains equity financing

C) has a high current ratio

D) has a high earnings per share

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a vertical analysis,the base for cost of goods sold is

A) total selling expenses

B) sales

C) total expenses

D) gross profit

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

If a firm has a current ratio of 2,the subsequent collection of a 60-day note receivable on account will cause the ratio to decrease.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 189

Related Exams