B) False

Correct Answer

verified

Correct Answer

verified

True/False

The supply of international reserves consists of owned reserves and borrowed reserves.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

With floating exchange rates,payments imbalances tend to be corrected by market-induced fluctuations in the exchange rate,and the need for exchange-rate stabilization and international reserves disappears.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A nation may experience debt-servicing problems because of

A) Pursuit of improper macroeconomic policies

B) Inadequate borrowing

C) Adverse economic events

D) Both a and c

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not considered an "owned" reserve?

A) National currencies

B) Gold

C) Special drawing rights

D) Oil facility

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The demand for international reserves is negatively related to the level of world prices and income.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a nation with a balance-of-payments deficit is willing and able to initiate quick actions to increase export receipts and decrease import payments,the amount of international reserves needed will be relatively large.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a condition of the international gold standard? That a nation must:

A) Convert gold into paper currency,and vice versa,at a stipulated rate

B) Permit gold to be freely imported and exported

C) Tolerate wide fluctuations in its exchange rate

D) Define its monetary unit in terms of a stipulated amount of gold

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

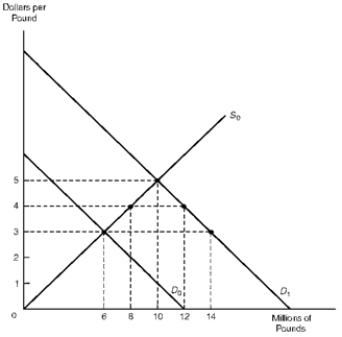

Figure 17.1 Foreign Exchange Market  -Refer to Figure 17.1.Under a fixed exchange rate system,U.S.monetary authorities would have to supply 8 million pounds in exchange for dollars to keep the exchange rate at $3 per pound.

-Refer to Figure 17.1.Under a fixed exchange rate system,U.S.monetary authorities would have to supply 8 million pounds in exchange for dollars to keep the exchange rate at $3 per pound.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following are major goals of the International Monetary Fund except:

A) Promoting international cooperation among member countries

B) Fostering a multilateral system of international payments

C) Making long-term development and reconstruction loans

D) Promoting exchange-rate stability and the elimination of exchange restrictions

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Debt reduction

A) Refers to any voluntary scheme that lessens the burden on the debtor nation

B) May be accomplished through debt rescheduling

C) May be achieved through debt/equity swaps

D) All of the above

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Under a debt-for-debt swap,a commercial bank sells its loans at a discount to a developing country government for local currency which it then uses to finance an equity investment in the debtor country.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

IMF drawings,swap arrangements,buffer stock facility,and compensatory financing for exports are classified as owned reserves rather than borrowed reserves.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To reduce their exposure to developing country debt,lending commercial banks have practiced all of the following except:

A) Making outright loan sales to other commercial banks

B) Reducing their capital base as a cushion against losses

C) Dealing in debt-for-debt swaps with foreign governments

D) Dealing in debt/equity swaps with foreign governments

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

By the 1990s,the British pound had replaced the U.S.dollar as the world's key currency.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The value of the SDR is tied to a currency basket consisting of the U.S.dollar,German mark,Japanese yen,French franc,and British pound.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In the 1970s,the major industrial countries abandoned the managed-floating exchange rate system and adopted a system of fixed exchange rates tied to the price of gold.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To reduce losses on developing country loans,commercial banks sometimes sell their loans,at a discount,to a developing country government for local currency which is then used to finance purchases of ownership shares in developing country industries.This practice is known as:

A) Debt forgiveness

B) Debt buyback

C) Debt-for-debt swap

D) Debt/equity swap

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Concerning international lending risk of commercial banks,____ is closely related to political developments in a borrowing country,especially the government's views concerning international investments and loans.

A) Economic risk

B) Credit risk

C) Country risk

D) Currency risk

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The exchange of borrowing country debt for an ownership position in the borrowing country is known as:

A) Debt forgiveness

B) Debt-for-debt swap

C) Debt reduction

D) Debt/equity swap

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 96

Related Exams