A) The lower the company's inventory turnover ratio, other things held constant, the lower the interest rate the bank would charge the firm.

B) Other things held constant, the higher the days sales outstanding ratio, the lower the interest rate the bank would charge.

C) Other things held constant, the lower the total debt to total capital ratio, the lower the interest rate the bank would charge.

D) The lower the company's TIE ratio, other things held constant, the lower the interest rate the bank would charge.

E) Other things held constant, the lower the current ratio, the lower the interest rate the bank would charge the firm.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A firm's ROE is equal to 9% and its ROA is equal to 6%.The firm finances only with short-term debt,long-term debt,and common equity,so assets equal total invested capital.The firm's total debt to total capital ratio must be 50%.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Debt management ratios show the extent to which a firm's managers are attempting to magnify returns on owners' capital through the use of financial leverage.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

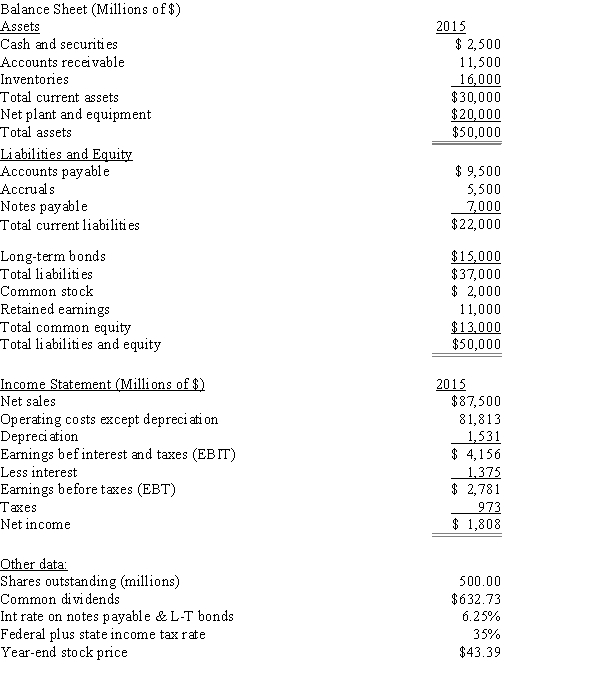

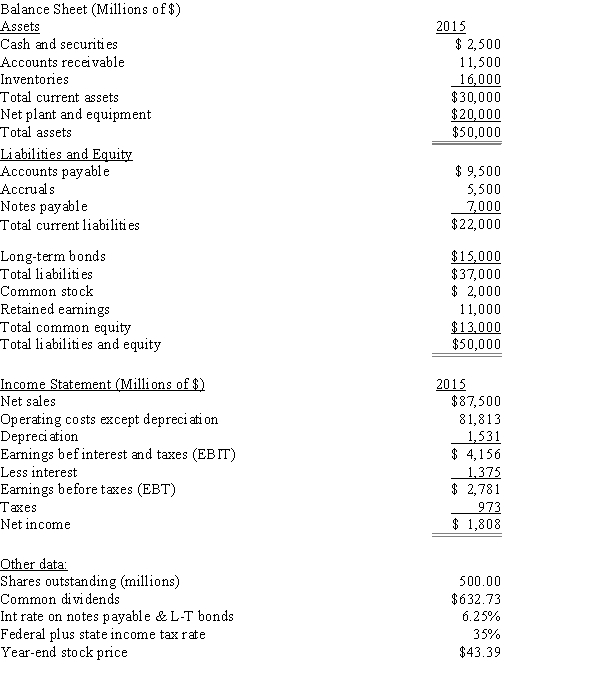

Exhibit 4.1

The balance sheet and income statement shown below are for Koski Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to Exhibit 4.1.What is the firm's days sales outstanding? Assume a 365-day year for this calculation.

-Refer to Exhibit 4.1.What is the firm's days sales outstanding? Assume a 365-day year for this calculation.

A) 39.07

B) 41.13

C) 43.29

D) 45.57

E) 47.97

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Since the ROA measures the firm's effective utilization of assets without considering how these assets are financed,two firms with the same EBIT must have the same ROA.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

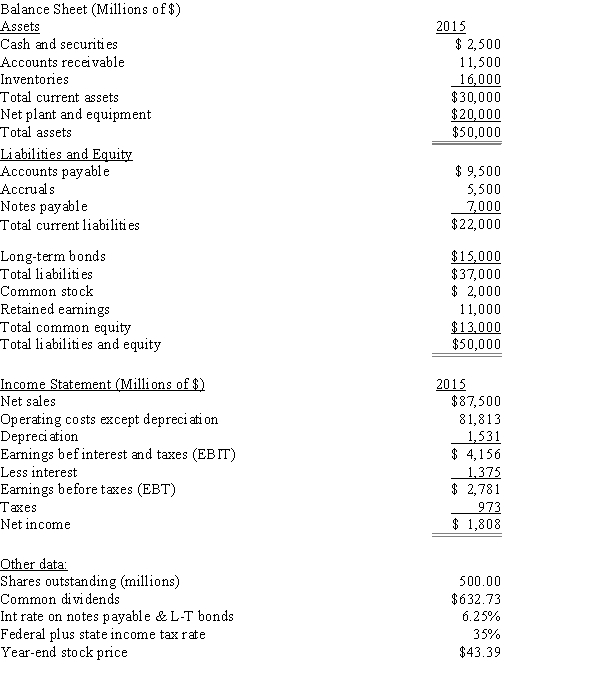

Exhibit 4.1

The balance sheet and income statement shown below are for Koski Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to Exhibit 4.1.What is the firm's inventory turnover ratio?

-Refer to Exhibit 4.1.What is the firm's inventory turnover ratio?

A) 5.47

B) 5.74

C) 6.03

D) 6.33

E) 6.65

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The market/book (M/B)ratio tells us how much investors are willing to pay for a dollar of accounting book value.In general,investors regard companies with higher M/B ratios as being less risky and/or more likely to enjoy higher growth in the future.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

High current and quick ratios always indicate that the firm is managing its liquidity position well.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

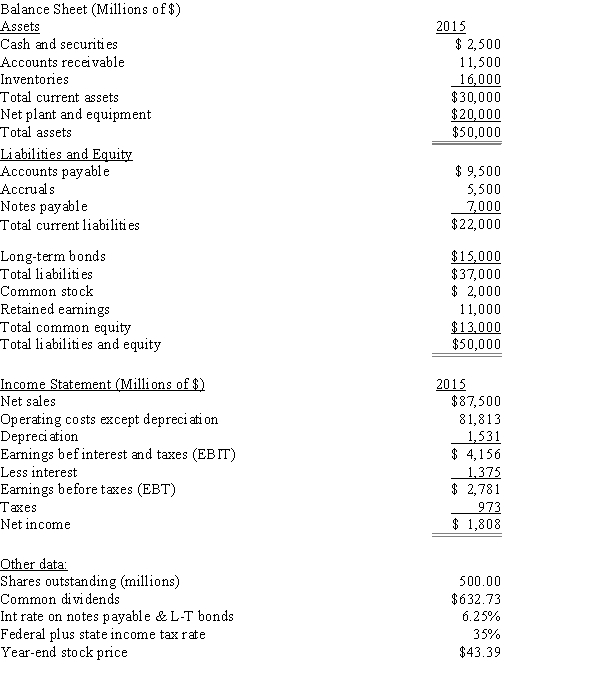

Exhibit 4.1

The balance sheet and income statement shown below are for Koski Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to Exhibit 4.1.What is the firm's dividends per share?

-Refer to Exhibit 4.1.What is the firm's dividends per share?

A) $1.14

B) $1.27

C) $1.39

D) $1.53

E) $1.68

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If one firm has a higher total debt to total capital ratio than another, we can be certain that the firm with the higher total debt to total capital ratio will have the lower TIE ratio, as that ratio depends entirely on the amount of debt a firm uses.

B) A firm's use of debt will have no effect on its profit margin.

C) If two firms differ only in their use of debt: i.e., they have identical assets, identical total invested capital, sales, operating costs, interest rates on their debt, and tax rates: but one firm has a higher total debt to total capital ratio, the firm that uses more debt will have a lower profit margin on sales and a lower return on assets.

D) The total debt to total capital ratio as it is generally calculated makes an adjustment for the use of assets leased under operating leases, so the debt ratios of firms that lease different percentages of their assets are still comparable.

E) If two firms differ only in their use of debt: i.e., they have identical assets, identical total invested capital, operating costs, and tax rates: but one firm has a higher total debt to total capital ratio, the firm that uses more debt will have a higher operating margin and return on assets.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A good bit of relatively simple algebra is involved in these problems, and although the calculations are simple, it will take students some time to set up the problems and do the arithmetic. We allow for this when assigning problems for a timed test. Also, note that students must know the definitions of a number of ratios to answer the questions. We provide our students with a formula sheet on exams, using the relevant sections of Appendix C at the then of the text. Otherwise, they spend too much time trying to memorize thing rather than trying to understand the issues. The difficulty of the problems depends on (1) whether or not students are provided with a formula sheet and (2) the amount of time they have to work the problems. Out difficulty assessments assume that they have a formula sheet and a "reasonable" amount of time for the test. Note that a few of the problems are trivially easy if students have formula sheets. To work some of the problems, students must transpose equations and solve for items that are normally inputs. For example, the equation for the profit margin is given as Profit margin = Net income/Sales. We might have a problem where sales and the profit margin are given and then require students to find the firm's net income. We explain to our students in class before the exam that they will have to transpose terms in the formulas to work some problems. Problems 84 through 114 are all stand-along problems with individualized data. Problems 115 through 133 are all based on a common set of financial statements, and they require students to calculate ratios and find items like EPS, TIE, and the like using this data set. The financial statements can be changed algorithmically, and this changes the calculated ratios and other items. -Ajax Corp's sales last year were $435,000,its operating costs were $362,500,and its interest charges were $12,500.What was the firm's times-interest-earned (TIE) ratio?

A) 4.72

B) 4.97

C) 5.23

D) 5.51

E) 5.80

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You observe that a firm's ROE is above the industry average,but both its profit margin and equity multiplier are below the industry average.Which of the following statements is CORRECT?

A) Its total assets turnover must be above the industry average.

B) Its return on assets must equal the industry average.

C) Its TIE ratio must be below the industry average.

D) Its total assets turnover must be below the industry average.

E) Its total assets turnover must equal the industry average.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The profit margin measures net income per dollar of sales.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

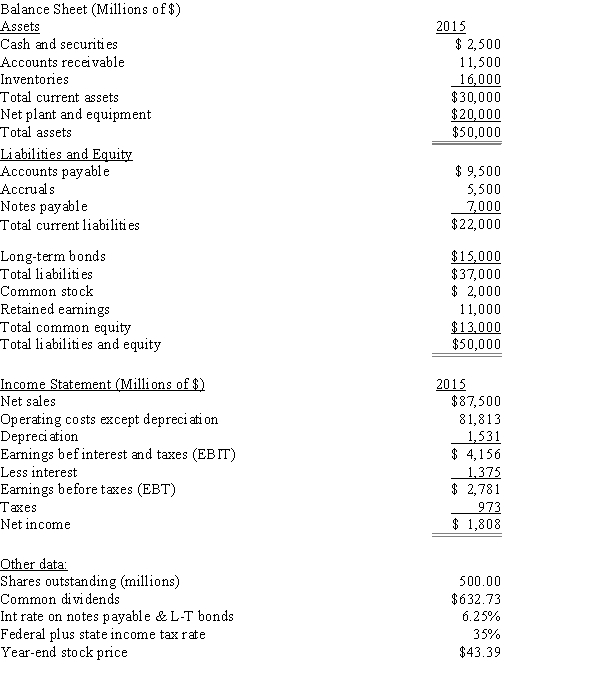

Exhibit 4.1

The balance sheet and income statement shown below are for Koski Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to Exhibit 4.1.What is the firm's EPS?

-Refer to Exhibit 4.1.What is the firm's EPS?

A) $3.26

B) $3.43

C) $3.62

D) $3.80

E) $3.99

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Exhibit 4.1

The balance sheet and income statement shown below are for Koski Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-Refer to Exhibit 4.1.What is the firm's current ratio?

-Refer to Exhibit 4.1.What is the firm's current ratio?

A) 0.99

B) 1.10

C) 1.23

D) 1.36

E) 1.50

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Other things held constant, the less debt a firm uses, the lower its return on total assets will be.

B) The advantage of the basic earning power ratio (BEP) over the return on total assets for judging a company's operating efficiency is that the BEP does not reflect the effects of debt and taxes.

C) The return on common equity (ROE) is generally regarded as being less significant, from a stockholder's viewpoint, than the return on total assets (ROA) .

D) The price/earnings (P/E) ratio tells us how much investors are willing to pay for a dollar of current earnings. In general, investors regard companies with higher P/E ratios as being more risky and/or less likely to enjoy higher future growth.

E) Suppose you are analyzing two firms in the same industry. Firm A has a profit margin of 10% versus a margin of 8% for Firm B. Firm A's total debt to total capital ratio is 70% versus 20% for Firm B. Based only on these two facts, you cannot reach a conclusion as to which firm is better managed, because the difference in debt, not better management, could be the cause of Firm A's higher profit margin.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year Ann Arbor Corp had $155,000 of assets (which equals total invested capital) ,$305,000 of sales,$20,000 of net income,and a debt-to-total-capital ratio of 37.5%.The new CFO believes a new computer program will enable it to reduce costs and thus raise net income to $33,000.The firm finances using only debt and common equity.Assets,total invested capital,sales,and the debt to capital ratio would not be affected.By how much would the cost reduction improve the ROE?

A) 11.51%

B) 12.11%

C) 12.75%

D) 13.42%

E) 14.09%

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

X-1 Corp's total assets at the end of last year were $405,000 and its EBIT was 52,500.What was its basic earning power (BEP) ratio?

A) 11.70%

B) 12.31%

C) 12.96%

D) 13.61%

E) 14.29%

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Other things held constant,the higher a firm's total debt to total capital ratio [measured as (Short-term debt + Long-term debt)/(Debt + Preferred stock + common equity)],the higher its TIE ratio will be.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If a firm's fixed assets turnover ratio is significantly higher than its industry average,this could indicate that it uses its fixed assets very efficiently or is operating at over capacity and should probably add fixed assets.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 133

Related Exams