A) The change in Accounts Receivable is added to net income; The change in Inventory is added to net income

B) The change in Accounts Receivable is added to net income; The change in Inventory is subtracted from net income

C) The change in Accounts Receivable is subtracted from net income; The change in Inventory is subtracted from net income

D) The change in Accounts Receivable is subtracted from net income; The change in Inventory is added to net income

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

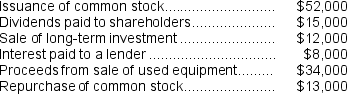

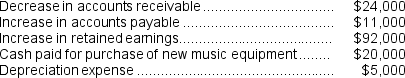

The following events occurred last year for the Cart Corporation:

Based solely on the above information,the net cash provided by (used in) financing activities for the year on the statement of cash flows was:

Based solely on the above information,the net cash provided by (used in) financing activities for the year on the statement of cash flows was:

A) $12,000

B) $24,000

C) $20,000

D) $49,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

In the statement of cash flows,collecting cash from customers is treated as a cash inflow in the financing activities section.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

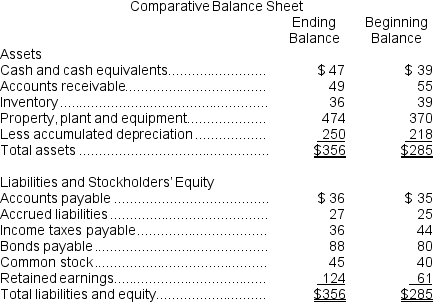

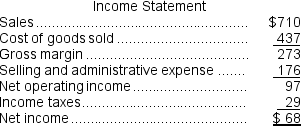

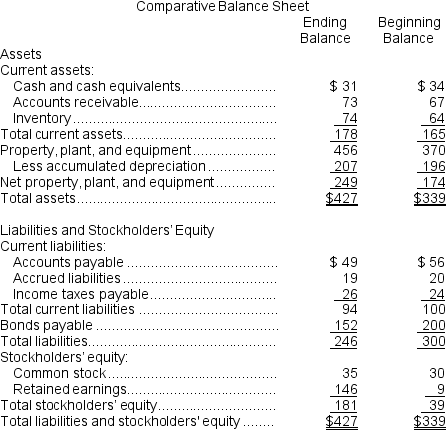

The most recent balance sheet and income statement of Penaloza Corporation appear below:

The company paid a cash dividend of $18. It did not dispose of any property, plant, and equipment. The company did not retire any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.

-The net cash provided by (used in) operating activities for the year was:

The company paid a cash dividend of $18. It did not dispose of any property, plant, and equipment. The company did not retire any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.

-The net cash provided by (used in) operating activities for the year was:

A) $117

B) $45

C) $36

D) $116

F) All of the above

Correct Answer

verified

Correct Answer

verified

Essay

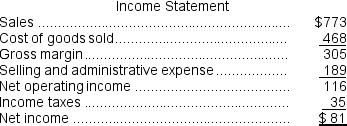

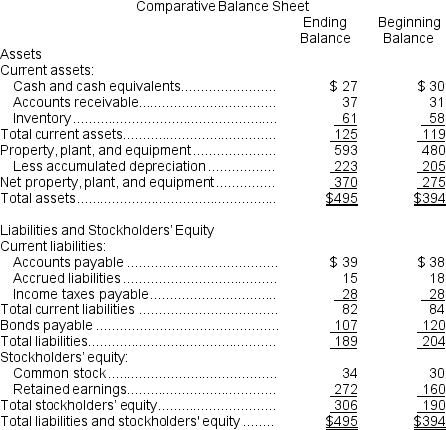

Beltram Corporation's balance sheet and income statement appear below:

The company did not dispose of any property,plant,and equipment,issue any bonds payable,or repurchase any of its own common stock during the year.The company declared and paid a cash dividend of $13.

Required:

Prepare a statement of cash flows in good form using the indirect method.

The company did not dispose of any property,plant,and equipment,issue any bonds payable,or repurchase any of its own common stock during the year.The company declared and paid a cash dividend of $13.

Required:

Prepare a statement of cash flows in good form using the indirect method.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

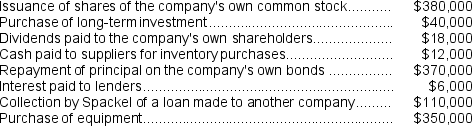

Klicker Corporation's most recent balance sheet appears below:

The company's net income for the year was $152 and it did not issue any bonds or repurchase any of its common stock during the year.Cash dividends were $40.The net cash provided by (used in) financing activities for the year was:

The company's net income for the year was $152 and it did not issue any bonds or repurchase any of its common stock during the year.Cash dividends were $40.The net cash provided by (used in) financing activities for the year was:

A) ($49)

B) ($40)

C) $4

D) ($13)

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

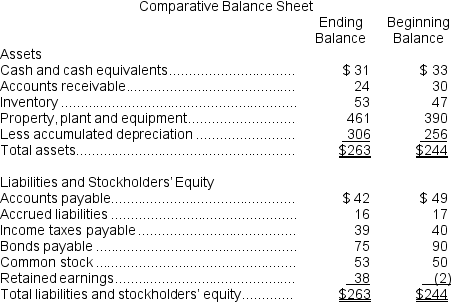

Salsedo Corporation's balance sheet and income statement appear below:

Cash dividends were $9. The company sold equipment for $15 that was originally purchased for $10 and that had accumulated depreciation of $5. It did not issue any bonds payable or repurchase any of its own common stock.

-The net cash provided by (used in) financing activities for the year was:

Cash dividends were $9. The company sold equipment for $15 that was originally purchased for $10 and that had accumulated depreciation of $5. It did not issue any bonds payable or repurchase any of its own common stock.

-The net cash provided by (used in) financing activities for the year was:

A) $(9)

B) $(15)

C) $(21)

D) $3

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

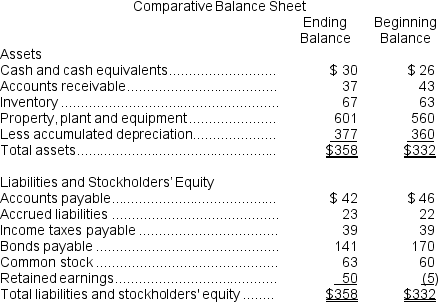

Carriveau Corporation's most recent balance sheet appears below:

Net income for the year was $172.Cash dividends were $35.The company did not sell or retire any property,plant,and equipment during the year.The net cash provided by (used in) operating activities for the year was:

Net income for the year was $172.Cash dividends were $35.The company did not sell or retire any property,plant,and equipment during the year.The net cash provided by (used in) operating activities for the year was:

A) $183

B) $246

C) $(11)

D) $161

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Essay

Manila Corporation's comparative balance sheet appears below:

The company's net income (loss)for the year was $0 and its cash dividends were $2,000.It did not dispose of any property,plant,and equipment,issue any bonds payable,or repurchase any of its own common stock during the year.

Required:

Compute the change in each balance sheet account denoted with an asterisk (*).Indicate whether the change in each balance will be recorded in the operating,investing,or financing activities section of the statement of cash flows.For items recorded in the operating activities section,also indicate whether the change will be added to or subtracted from net income.For all other items,indicate whether the change will be added as a cash inflow or subtracted as a cash outflow.The first entry has been filled in as an example.

The company's net income (loss)for the year was $0 and its cash dividends were $2,000.It did not dispose of any property,plant,and equipment,issue any bonds payable,or repurchase any of its own common stock during the year.

Required:

Compute the change in each balance sheet account denoted with an asterisk (*).Indicate whether the change in each balance will be recorded in the operating,investing,or financing activities section of the statement of cash flows.For items recorded in the operating activities section,also indicate whether the change will be added to or subtracted from net income.For all other items,indicate whether the change will be added as a cash inflow or subtracted as a cash outflow.The first entry has been filled in as an example.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following transactions should be classified as a financing activity on the statement of cash flows?

A) Purchase of equipment.

B) Purchase of the company's own stock.

C) Sale of a long-term investment.

D) Payment of interest to a lender.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The direct method of preparing the statement of cash flows will show the same increase or decrease in cash as the indirect method.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

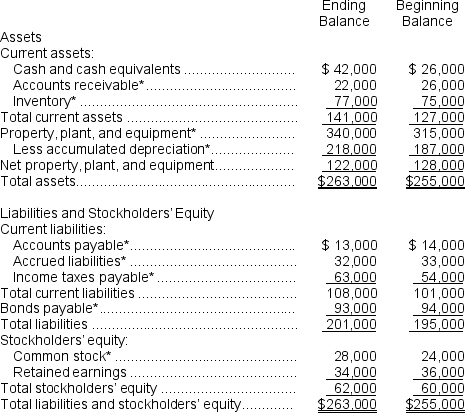

Spackel Corporation recorded the following events last year:

On the statement of cash flows, some of these events are classified as operating activities, some are classified as investing activities, and some are classified as financing activities.

-Based solely on the information above,the net cash provided by (used in) investing activities on the statement of cash flows would be:

On the statement of cash flows, some of these events are classified as operating activities, some are classified as investing activities, and some are classified as financing activities.

-Based solely on the information above,the net cash provided by (used in) investing activities on the statement of cash flows would be:

A) $(280,000)

B) $(390,000)

C) $(760,000)

D) $(1,286,000)

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

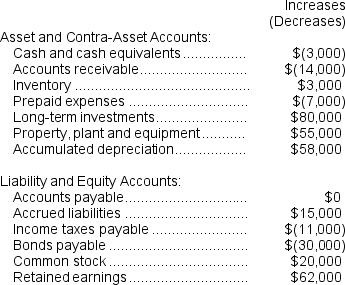

Megan Corporation's net income last year was $98,000. Changes in the company's balance sheet accounts for the year appear below:

The company paid a cash dividend of $36,000 and it did not dispose of any long-term investments or property, plant, and equipment. The company did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.

-The net cash provided by (used in) investing activities last year was:

The company paid a cash dividend of $36,000 and it did not dispose of any long-term investments or property, plant, and equipment. The company did not issue any bonds payable or repurchase any of its own common stock. The following questions pertain to the company's statement of cash flows.

-The net cash provided by (used in) investing activities last year was:

A) $115,000

B) $(115,000)

C) $135,000

D) $(135,000)

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Klutz Dance Studio had net income of $167,000 for the year just ended.Klutz collected the following additional information to prepare its statement of cash flows for the year:

Klutz uses the indirect method to prepare its statement of cash flows.What is Klutz's net cash provided by (used in) operating activities?

Klutz uses the indirect method to prepare its statement of cash flows.What is Klutz's net cash provided by (used in) operating activities?

A) $95,000

B) $137,000

C) $185,000

D) $207,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Free cash flow will increase if a company increases its accounts payable balance by delaying payments to suppliers.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Paying interest to lenders is classified as an operating activity on the statement of cash flows.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

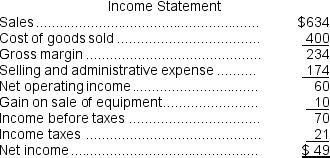

The most recent comparative balance sheet of Giacomelli Corporation appears below:

The company uses the indirect method to construct the operating activities section of its statement of cash flows.

-Which of the following is correct regarding the operating activities section of the statement of cash flows?

The company uses the indirect method to construct the operating activities section of its statement of cash flows.

-Which of the following is correct regarding the operating activities section of the statement of cash flows?

A) The change in Accounts Receivable will be subtracted from net income; The change in Inventory will be added to net income

B) The change in Accounts Receivable will be added to net income; The change in Inventory will be subtracted from net income

C) The change in Accounts Receivable will be added to net income; The change in Inventory will be added to net income

D) The change in Accounts Receivable will be subtracted from net income; The change in Inventory will be subtracted from net income

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a statement of cash flows,the sale of a long-term investment would ordinarily be classified as:

A) an operating activity.

B) a financing activity.

C) an investing activity.

D) a lending activity.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Cash payments to repay the principal amount of debt are reported as a cash outflow in the investing activities section of the statement of cash flows.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Under the indirect method of determining the net cash provided by operating activities on the statement of cash flows,an increase in accounts receivable would be subtracted from net income.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 132

Related Exams