A) $9,900

B) $3,400

C) $10,700

D) $17,100

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

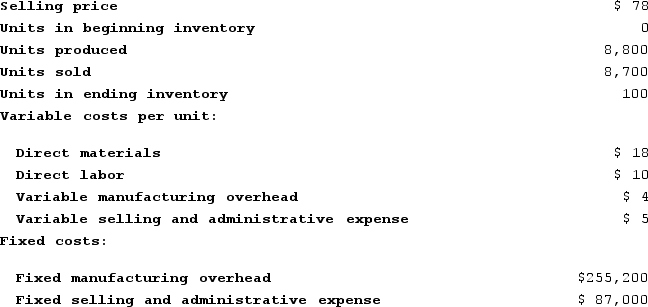

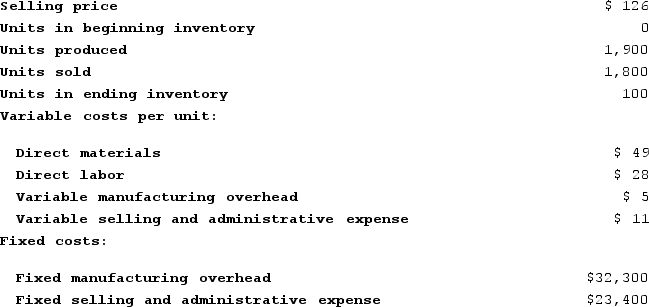

Farris Corporation, which has only one product, has provided the following data concerning its most recent month of operations:  What is the unit product cost for the month under absorption costing?

What is the unit product cost for the month under absorption costing?

A) $32 per unit

B) $61 per unit

C) $37 per unit

D) $66 per unit

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

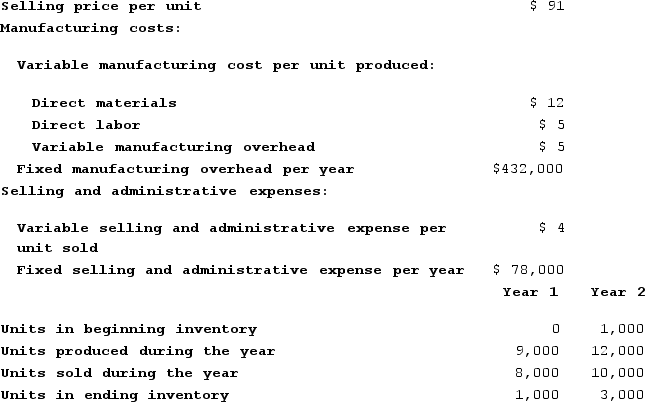

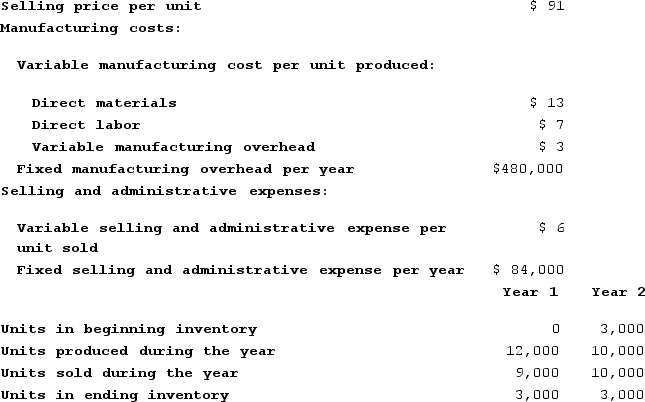

Cahalane Corporation has provided the following data for its two most recent years of operation:  Which of the following statements is true for Year 1?

Which of the following statements is true for Year 1?

A) The amount of fixed manufacturing overhead deferred in inventories is $48,000

B) The amount of fixed manufacturing overhead released from inventories is $560,000

C) The amount of fixed manufacturing overhead deferred in inventories is $560,000

D) The amount of fixed manufacturing overhead released from inventories is $48,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

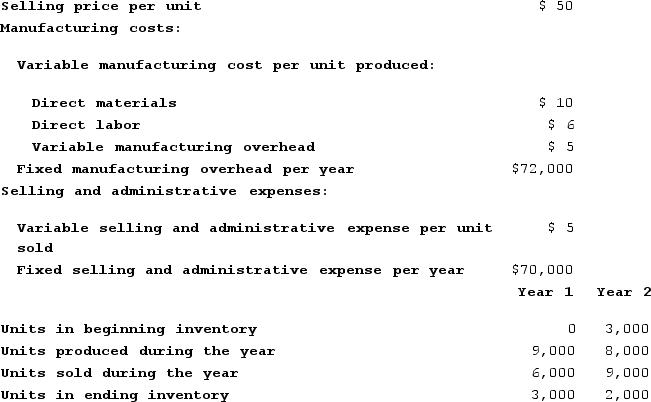

Mandato Corporation has provided the following data for its two most recent years of operation:  The net operating income (loss) under absorption costing in Year 2 is closest to:

The net operating income (loss) under absorption costing in Year 2 is closest to:

A) $74,000

B) $183,000

C) $68,000

D) $138,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Segment margin is sales less variable expenses less traceable fixed expenses.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Marcelin Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:  The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 51,000 units and sold 46,000 units. The company's only product is sold for $276 per unit.The company is considering using either super-variable costing or a variable costing system that assigns $22 of direct labor cost to each unit that is produced. Which of the following statements is true regarding the net operating income in the first year?

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 51,000 units and sold 46,000 units. The company's only product is sold for $276 per unit.The company is considering using either super-variable costing or a variable costing system that assigns $22 of direct labor cost to each unit that is produced. Which of the following statements is true regarding the net operating income in the first year?

A) Variable costing net operating income exceeds super-variable costing net operating income by $110,000.

B) Super-variable costing net operating income exceeds variable costing net operating income by $385,000.

C) Super-variable costing net operating income exceeds variable costing net operating income by $110,000.

D) Variable costing net operating income exceeds super-variable costing net operating income by $385,000.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Net operating income computed using absorption costing will always be less than net operating income computed using variable costing.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ross Corporation produces a single product. The company has direct materials costs of $8 per unit, direct labor costs of $6 per unit, and manufacturing overhead of $10 per unit. Sixty percent of the manufacturing overhead is for fixed costs. In addition, variable selling and administrative expenses are $2 per unit, and fixed selling and administrative expenses are $3 per unit at the current activity level. Assume that direct labor is a variable cost.Under absorption costing, the unit product cost is:

A) $24 per unit

B) $20 per unit

C) $26 per unit

D) $29 per unit

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

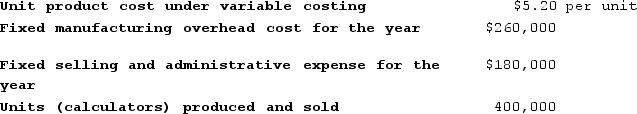

Shun Corporation manufactures and sells a hand held calculator. The following information relates to Shun's operations for last year:  What is Shun's absorption costing unit product cost for last year?

What is Shun's absorption costing unit product cost for last year?

A) $4.10 per unit

B) $4.55 per unit

C) $5.85 per unit

D) $6.30 per unit

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

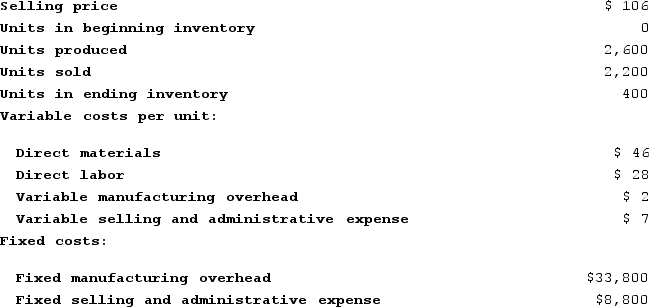

Gabuat Corporation, which has only one product, has provided the following data concerning its most recent month of operations:  What is the total period cost for the month under variable costing?

What is the total period cost for the month under variable costing?

A) $42,600

B) $33,800

C) $24,200

D) $58,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Assuming the LIFO inventory flow assumption, when production exceeds sales for the period, absorption costing net operating income will exceed variable costing net operating income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is true of a company that uses absorption costing?

A) Net operating income fluctuates directly with changes in sales volume.

B) Fixed production and fixed selling costs are considered to be product costs.

C) Unit product costs can change as a result of changes in the number of units manufactured.

D) Variable selling expenses are included in product costs.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

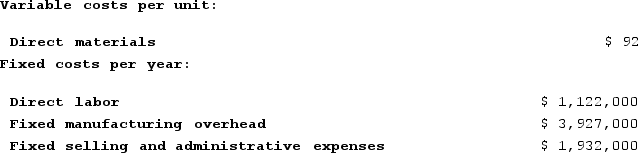

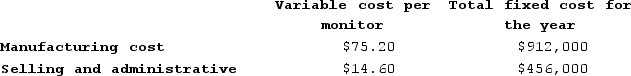

McCoy Corporation manufactures a computer monitor. Shown below is McCoy's cost structure:  In its first year of operations, McCoy produced 100,000 monitors but only sold 95,000. McCoy's gross margin in this first year was $2,629,600. McCoy's contribution margin in this first year was $2,109,000.Under variable costing, what is McCoy's net operating income for its first year?

In its first year of operations, McCoy produced 100,000 monitors but only sold 95,000. McCoy's gross margin in this first year was $2,629,600. McCoy's contribution margin in this first year was $2,109,000.Under variable costing, what is McCoy's net operating income for its first year?

A) $266,000

B) $741,000

C) $1,261,600

D) $2,173,600

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

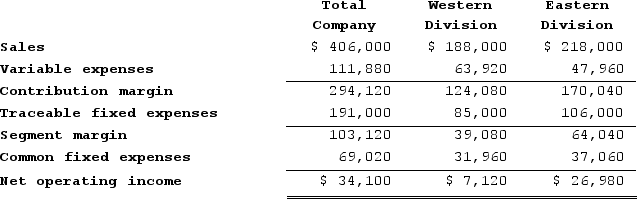

Jemmott Corporation has two divisions: Western Division and Eastern Division. The following report is for the most recent operating period:  The common fixed expenses have been allocated to the divisions on the basis of sales.The company's overall break-even sales is closest to:

The common fixed expenses have been allocated to the divisions on the basis of sales.The company's overall break-even sales is closest to:

A) $94,243

B) $271,743

C) $264,685

D) $358,929

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Hadley Corporation, which has only one product, has provided the following data concerning its most recent month of operations:  The total contribution margin for the month under variable costing is:

The total contribution margin for the month under variable costing is:

A) $27,100

B) $59,400

C) $48,600

D) $79,200

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

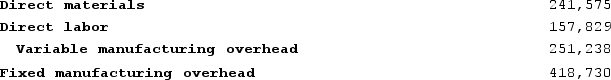

Krepps Corporation produces a single product. Last year, Krepps manufactured 32,210 units and sold 26,700 units. Production costs for the year were as follows:  Sales totaled $1,241,550 for the year, variable selling and administrative expenses totaled $138,840, and fixed selling and administrative expenses totaled $199,702. There was no beginning inventory. Assume that direct labor is a variable cost.The contribution margin per unit was:

Sales totaled $1,241,550 for the year, variable selling and administrative expenses totaled $138,840, and fixed selling and administrative expenses totaled $199,702. There was no beginning inventory. Assume that direct labor is a variable cost.The contribution margin per unit was:

A) $26.30 per unit

B) $21.10 per unit

C) $16.80 per unit

D) $22.80 per unit

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Marcelin Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:  The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 48,400 units and sold 46,700 units. The company's only product is sold for $240 per unit.The net operating income for the year under super-variable costing is:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 48,400 units and sold 46,700 units. The company's only product is sold for $240 per unit.The net operating income for the year under super-variable costing is:

A) $4,789,100

B) $2,723,700

C) $7,612,100

D) $723,500

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tubaugh Corporation has two major business segments--East and West. In December, the East business segment had sales revenues of $380,000, variable expenses of $205,000, and traceable fixed expenses of $45,000. During the same month, the West business segment had sales revenues of $1,050,000, variable expenses of $536,000, and traceable fixed expenses of $201,000. The common fixed expenses totaled $310,000 and were allocated as follows: $155,000 to the East business segment and $155,000 to the West business segment.A properly constructed segmented income statement in a contribution format would show that the segment margin of the East business segment is:

A) $205,000

B) $130,000

C) $(20,000)

D) $(23,000)

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Miscavage Corporation has two divisions: the Beta Division and the Alpha Division. The Beta Division has sales of $285,000, variable expenses of $147,600, and traceable fixed expenses of $68,800. The Alpha Division has sales of $595,000, variable expenses of $329,800, and traceable fixed expenses of $129,500. The total amount of common fixed expenses not traceable to the individual divisions is $130,200. What is the company's net operating income?

A) $204,300

B) $402,600

C) $74,100

D) $265,200

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

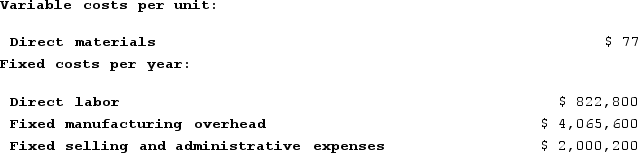

Moskowitz Corporation has provided the following data for its two most recent years of operation:  Which of the following statements is true for Year 2?

Which of the following statements is true for Year 2?

A) The amount of fixed manufacturing overhead released from inventories is $686,000

B) The amount of fixed manufacturing overhead released from inventories is $24,000

C) The amount of fixed manufacturing overhead deferred in inventories is $686,000

D) The amount of fixed manufacturing overhead deferred in inventories is $24,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 361 - 380 of 392

Related Exams