A) quantity demanded would exceed quantity supplied.

B) quantity supplied would exceed quantity demanded.

C) the demand curve would have to shift.

D) the supply curve would have to shift.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

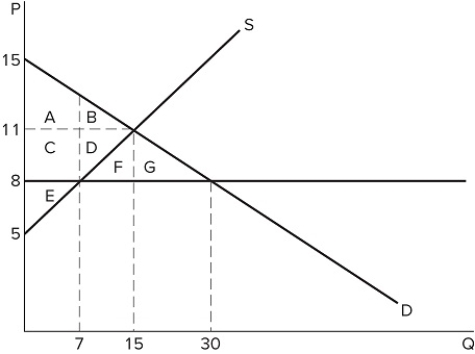

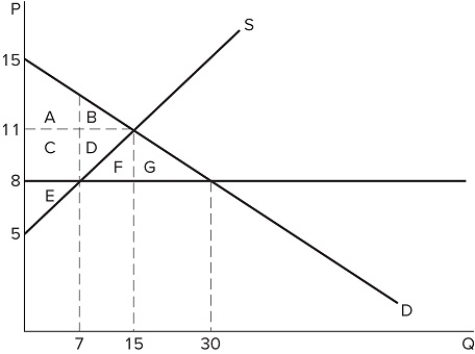

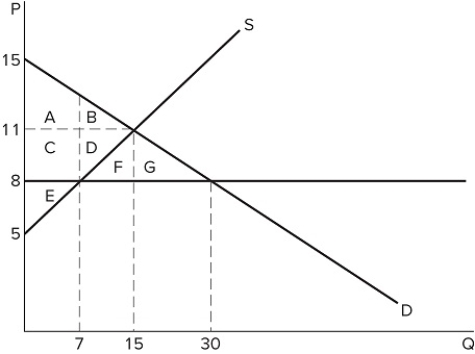

If a price ceiling is set at $8 in the market shown in the graph, which area(s) would represent the surplus that is transferred from producers to consumers?

If a price ceiling is set at $8 in the market shown in the graph, which area(s) would represent the surplus that is transferred from producers to consumers?

A) C + D + F + G

B) C + D

C) F + G

D) C

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

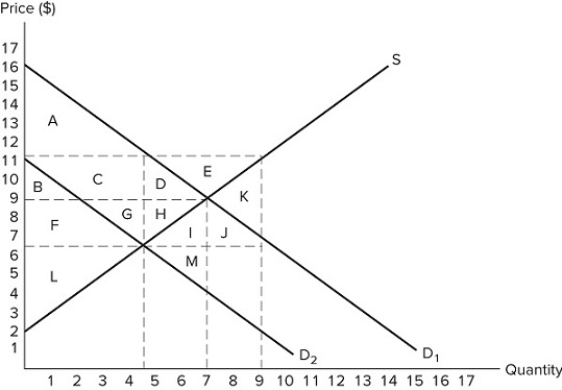

Which action could cause the price ceiling shown in the graph to become non-binding?

Which action could cause the price ceiling shown in the graph to become non-binding?

A) An increase in demand (shift to the right)

B) A decrease in supply (shift to the left)

C) An increase in supply (shift to the right)

D) None of these would cause the price ceiling to become non-binding.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is placed on sellers:

A) sellers always bear a higher tax incidence than buyers.

B) buyers always bear a higher tax incidence than sellers.

C) its effect on the price buyers pay and sellers receive equals that of a tax on buyers.

D) None of these are correct.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

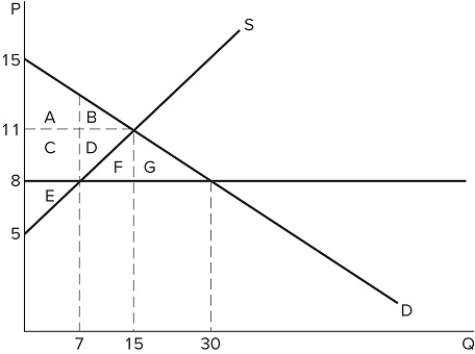

The graph shown portrays a subsidy to buyers. What area(s) represent the deadweight loss that arises from this subsidy?

The graph shown portrays a subsidy to buyers. What area(s) represent the deadweight loss that arises from this subsidy?

A) D + H

B) K

C) E

D) I + M

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a price ceiling is set at $8 in the market in the graph shown, the total number of units traded will:

If a price ceiling is set at $8 in the market in the graph shown, the total number of units traded will:

A) fall by 8, relative to equilibrium.

B) fall by 15, relative to equilibrium.

C) fall by 23, relative to equilibrium.

D) increase by 15, relative to equilibrium.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

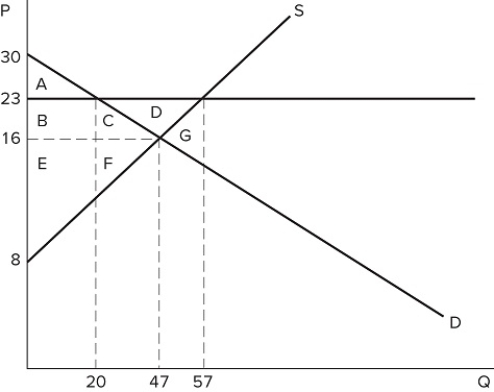

Which action could cause the price ceiling shown in the graph to become non-binding?

Which action could cause the price ceiling shown in the graph to become non-binding?

A) An increase in demand (shift to the right)

B) A decrease in demand (shift to the left)

C) A decrease in supply (shift to the left)

D) None of these would cause the price ceiling to become non-binding.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a price floor is set at $23 in the market shown in the graph, which area(s) would represent total surplus?

If a price floor is set at $23 in the market shown in the graph, which area(s) would represent total surplus?

A) A

B) B + C + E + F

C) A + B + E

D) A + B + C + E + F

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

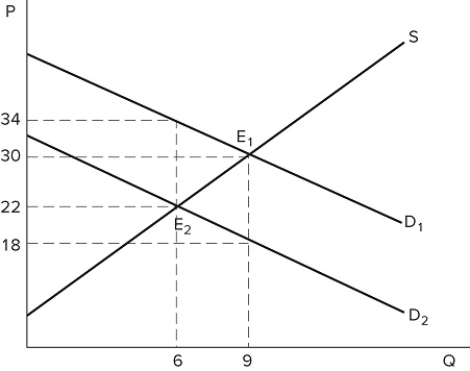

The graph shown demonstrates a tax on sellers. What is the amount of tax revenue being generated?

The graph shown demonstrates a tax on sellers. What is the amount of tax revenue being generated?

A) $150

B) $80

C) $310

D) $135

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For a price ceiling to have an impact on a market it must be set:

A) above the equilibrium price.

B) below the equilibrium price.

C) equal to the equilibrium price.

D) anywhere along the demand curve.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

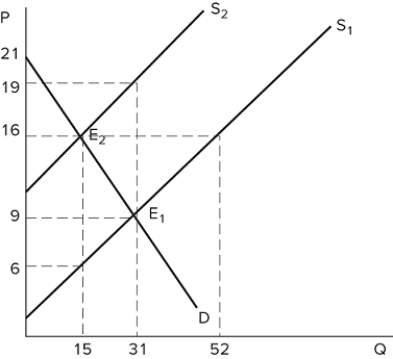

The graph shown demonstrates a tax on buyers. How many fewer units are being sold due to the imposition of a tax on this market?

The graph shown demonstrates a tax on buyers. How many fewer units are being sold due to the imposition of a tax on this market?

A) 6

B) 9

C) 3

D) 12

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 161 - 171 of 171

Related Exams