A) sales invoice

B) purchase invoice

C) credit memo

D) debit memo

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

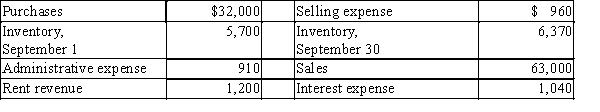

Using the following information for a periodic inventory system, what is the amount of net income?

A) $29,510

B) $29,960

C) $28,310

D) $29,350

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following accounts carry a normal credit balance?

A) Sales Tax Payable, Cost of Goods Sold, and Sales

B) Inventory, Delivery Expense, and Sales

C) Customer Refunds Payable, Estimated Returns Inventory, and Sales

D) Sales Tax Payable, Customer Refunds Payable, and Sale

F) A) and C)

Correct Answer

verified

D

Correct Answer

verified

True/False

Cost of goods sold is the amount that the merchandising company pays for the merchandise it intends to sell.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When a large quantity of merchandise is purchased, a reduction allowed on the sale price is called a trade discount.

B) False

Correct Answer

verified

True

Correct Answer

verified

Essay

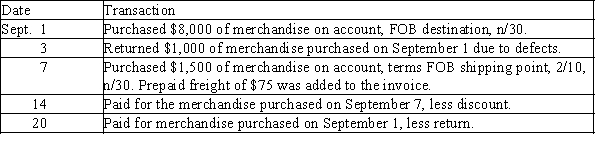

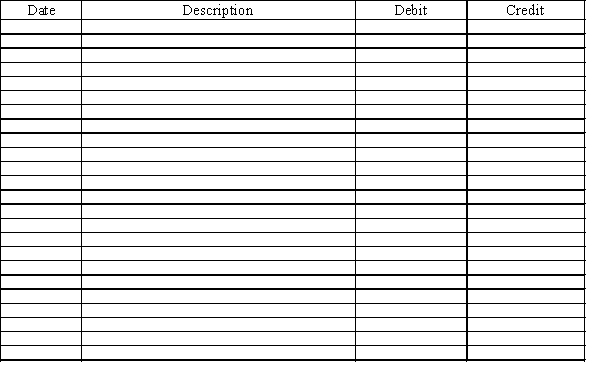

Record the following transactions related to purchases for Horston's Art Supplies using the general journal form provided below. Assume Horston's uses a periodic inventory system. Omit transaction descriptions from entries.

Correct Answer

verified

Correct Answer

verified

True/False

The abbreviation FOB stands for "free on board."

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The fees associated with credit card sales are periodically recorded as expenses.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Cost of goods sold is often the largest expense on a merchandising company income statement.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What is the major difference between a periodic and perpetual inventory system?

A) Under the periodic inventory system, the purchase of inventory will be debited to the Purchases account.

B) Under the periodic inventory system, no journal entry is recorded at the time of the sale of inventory for the cost of the inventory.

C) Under the periodic inventory system, all adjustments such as purchases returns and allowances and discounts are reconciled at the end of the accounting period.

D) All of the answers are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The arrangements between buyer and seller as to when payments for merchandise are to be made are called

A) credit terms

B) net cash

C) cash on demand

D) gross cash

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Inventory is classified on the balance sheet as a

A) current liability

B) current asset

C) long-term asset

D) long-term liability

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The seller may prepay the freight costs even though the terms are FOB shipping point.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Bountiful Company had sales of $650,000 and cost of goods sold of $200,000 during a year. The total assets balance at the beginning of the year was $175,000 and at the end of the year was $167,000. Calculate the asset turnover ratio.

A) 3.00

B) 3.80

C) 0.29

D) 0.26

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following accounts should be closed to Retained Earnings at the end of the fiscal year?

A) Inventory

B) Accumulated Depreciation

C) Customer Refunds Payable

D) Cost of Goods Sold

F) B) and C)

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

Gross profit is equal to

A) sales plus cost of goods sold

B) sales plus selling expenses

C) sales less selling expenses

D) sales less cost of goods sold

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Essay

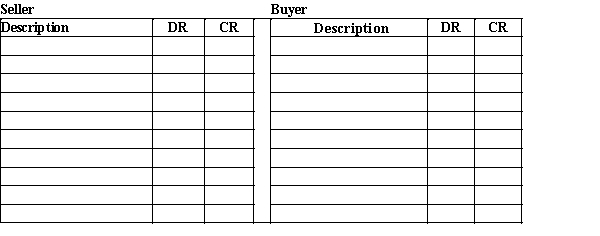

Based on the information below, journalize the entries for the seller and the buyer. Both use a perpetual inventory system.(a)Seller sold merchandise on account to the buyer, $4,750, terms 2/10, net 30, FOB shipping point. The cost of the merchandise is $2,850. The seller prepays the freight of $75.(b)Buyer returns $700 of merchandise as defective. The cost of the merchandise is $420.(c)Buyer pays within the discount period.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

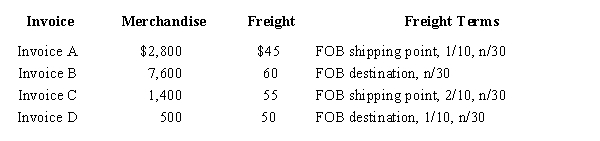

Details of invoices for purchases of merchandise are as follows:  What will be the total amount collected on all four invoices, assuming that credit for returns and allowances was received prior to payment and that all invoices were paid within the discount period.

What will be the total amount collected on all four invoices, assuming that credit for returns and allowances was received prior to payment and that all invoices were paid within the discount period.

A) $10,653

B) $10,753

C) $10,803

D) $$10,863

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Merchandise is sold for cash. The selling price of the merchandise is $6,000 and the sale is subject to a 7% state sales tax. The journal entry to record the sale would include a credit to

A) Cash for $6,000

B) Sales for $6,420

C) Sales Tax Payable for $420

D) Sales for $5,580

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

In a merchandising business, sales minus operating expenses equals net income.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 273

Related Exams