B) False

Correct Answer

verified

Correct Answer

verified

True/False

Budget performance reports prepared for the vice president of production would generally contain less detail than reports prepared for the various plant managers.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A franchise fee is often expressed as a percent of revenues earned by the franchisee.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Operating income of the Pierce Automobile Division is $2,225,000. If operating income before support department allocations is $3,250,000,

A) operating expenses are $1,025,000

B) total support department allocations are $1,025,000

C) noncontrollable charges are $1,025,000

D) direct manufacturing charges are $1,025,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

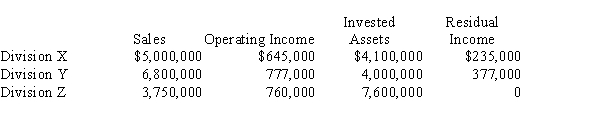

The sales, operating income, invested assets, and residual income for each division of Marcus Company are as follows:  Determine the minimum return on invested assets

Determine the minimum return on invested assets

Correct Answer

verified

Correct Answer

verified

Essay

Materials used by Layton Company's Division 1 are currently purchased from outside supplier at $58 per unit. Division 2 is able to supply Division 1 with 20,000 units at a variable cost of $46 per unit. The two divisions have recently negotiated a transfer price of $50 per unit for the 20,000 units. a. By how much will each division's income increase as a result of this transfer? b. What is the total increase in income for Layton Company?

Correct Answer

verified

Correct Answer

verified

True/False

The profit center income statement should include only controllable revenues and expenses.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The process of measuring and reporting operating data by responsibility centers is termed responsibility accounting.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

It is beneficial for divisions in a company to negotiate a transfer price when the supplying division has unused capacity in its plant.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The right or license granted to an individual or group to market another company's goods or services is called a franchise.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In return on investment analysis, the investment turnover component focuses on efficiency in the use of assets and indicates the rate at which sales are being generated for each dollar of invested assets.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The operating income of the Macro Division after all support department allocations will be

A) $780,000

B) $375,000

C) $575,000

D) $435,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

If the profit margin for a division is 8% and the investment turnover is 1.2, the return on investment is 9.6%.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Operating expenses directly traceable to or incurred for the sole benefit of a specific department and usually subject to the control of the department manager are _____ expenses.

A) miscellaneous administrative

B) direct operating

C) indirect

D) fixed

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

A manager in a cost center also has responsibility and authority over the revenues.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a disadvantage of decentralization?

A) Decisions made by one manager may negatively affect the profitability of the entire company.

B) Decentralization helps retain quality managers.

C) Managers closest to the operations make decisions.

D) Managers are able to acquire expertise in their areas of responsibility.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Three measures of investment center performance are operating income, return on investment, and residual income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Mason Corporation had $650,000 in invested assets, sales of $700,000, operating income amounting to $99,000, and a desired minimum return on investment of 15%. -The investment turnover for Mason Corporation is

A) 1.08

B) 0.93

C) 6.57

D) 7.07

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The operating income of the Super Division after all support department allocations will be

A) $300,000

B) $325,000

C) $550,000

D) $200,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If divisional operating income is $75,000, invested assets are $737,500, and the minimum return on invested assets is 6%, the residual income is $36,750.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 210

Related Exams