B) False

Correct Answer

verified

Correct Answer

verified

True/False

A series of equal cash flows at fixed intervals is termed an annuity.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each definition that follows with the term (a-e) it defines. -Recognizes that a dollar today is worth more than a dollar tomorrow

A) Capital investment analysis

B) Time value of money concept

C) Net present value method

D) Average rate of return

E) Cash payback period

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A present value index can be used to rank competing capital investment proposals when the net present value method is used.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each of the methods that follow with the correct category (a or b) . -Average rate of return method

A) Method that does not use present value

B) Method that uses present value

D) undefined

Correct Answer

verified

Correct Answer

verified

True/False

A qualitative characteristic that may impact capital investment analysis is manufacturing flexibility.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The production department is proposing the purchase of an automatic insertion machine. It has identified three machines and has asked the accountant to analyze them to determine the best average rate of return. Which machine has the best average rate of return?

A) Machine B

B) Machine C

C) Machines A and B

D) Machine A

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The excess of the cash flowing in from revenues over the cash flowing out for expenses is termed net cash flow.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Only managers are encouraged to submit capital investment proposals because they know the processes and are able to match investments with long-term goals.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each definition that follows with the term (a-f) it defines. -Uses present value concepts to compute the rate of return on an investment from a capital investment proposal based on its expected net cash flows

A) Capital rationing

B) Annuity

C) Capital investment analysis

D) Internal rate of return method

E) Payback period

F) Accounting rate of return

H) B) and F)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

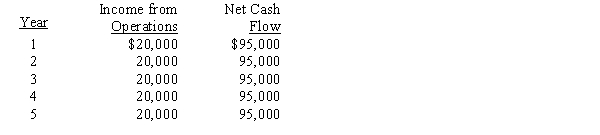

An anticipated purchase of equipment for $490,000 with a useful life of eight years and no residual value is expected to yield the following annual net incomes and net cash flows:? What is the cash payback period?

A) 5 years

B) 4 years

C) 6 years

D) 3 years

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

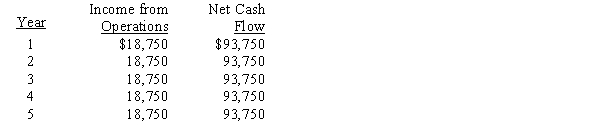

The management of River Corporation is considering the purchase of a new machine costing $380,000. The company's desired rate of return is 6%. The present value factor for an annuity of $1 at interest of 6% for five years is 4.212. In addition to the foregoing information, use the following data in determining the acceptability of this investment:

-The cash payback period for this investment is

-The cash payback period for this investment is

A) 4 years

B) 5 years

C) 20 years

D) 3 years

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The average rate of return method of analyzing capital budgeting decisions measures the average rate of return from using the asset over its entire life.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company is contemplating investing in a new piece of manufacturing machinery. The amount to be invested is $100,000. The present value of the future cash flows at the company's desired rate of return is $105,000. The IRR on the project is 12%. Which of the following statements is true?

A) The project should not be accepted because the net present value is negative.

B) The desired rate of return used to calculate the present value of the future cash flows is less than 12%.

C) The desired rate of return used to calculate the present value of the future cash flows is more than 12%.

D) The desired rate of return used to calculate the present value of the future cash flows is equal to 12%.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An analysis of a proposal by the net present value method indicated that the present value of future cash inflows exceeded the amount to be invested. Which of the following statements best describes the results of this analysis?

A) The proposal is desirable, and the rate of return expected from the proposal exceeds the minimum rate used for the analysis.

B) The proposal is desirable, and the rate of return expected from the proposal is less than the minimum rate used for the analysis.

C) The proposal is undesirable, and the rate of return expected from the proposal is less than the minimum rate used for the analysis.

D) The proposal is undesirable, and the rate of return expected from the proposal exceeds the minimum rate used for the analysis.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each definition that follows with the term (a-f) it defines. -The length of time it will take to recover through cash inflows the dollars of a capital outlay

A) Capital rationing

B) Annuity

C) Capital investment analysis

D) Internal rate of return method

E) Payback period

F) Accounting rate of return

H) C) and F)

Correct Answer

verified

Correct Answer

verified

True/False

A qualitative characteristic that may impact capital investment analysis is the impact of investment proposals on product quality.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Methods that ignore present value in capital investment analysis include the net present value method.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The average rate of return method of capital investment analysis gives consideration to the present value of future cash flows.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The management of Wyoming Corporation is considering the purchase of a new machine costing $375,000. The company's desired rate of return is 6%. The present value factor for an annuity of $1 at interest of 6% for five years is 4.212. In addition to the foregoing information, use the following data in determining the acceptability of this investment:

-The net present value for this investment is

-The net present value for this investment is

A) $(118,145)

B) $118,145

C) $19,875

D) $(19,875)

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 189

Related Exams