B) False

Correct Answer

verified

Correct Answer

verified

True/False

Reggie owns all the stock of Amethyst, Inc.adjusted basis of $100,000).If he receives a distribution from Amethyst of $90,000 and corporate earnings and profits are $15,000, Reggie has a capital gain of $5,000 and an adjusted basis for his Amethyst stock of $0.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If boot is received in a § 1031 like-kind exchange that results in some of the realized gain being recognized, the holding period for both the like-kind property and the boot received begins on the date of the exchange.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Gift property disregarding any adjustment for gift tax paid by the donor) :

A) Has no basis to the donee because he or she did not pay anything for the property.

B) Has the same basis to the donee as the donor's adjusted basis if the donee disposes of the property at a gain.

C) Has the same basis to the donee as the donor's adjusted basis if the donee disposes of the property at a loss, and the fair market value on the date of gift was less than the donor's adjusted basis.

D) Has no basis to the donee if the fair market value on the date of gift is less than the donor's adjusted basis.

E) None of the above.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The surrender of depreciated boot fair market value is less than adjusted basis) in a like-kind exchange can result in the recognition of loss.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

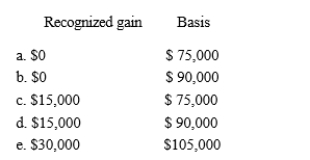

Nat is a salesman for a real estate developer.His employer permits him to purchase a lot for $75,000.The employer's adjusted basis for the lot is $45,000, and its normal selling price is $90,000. What is Nat's recognized gain and his basis for the lot?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pedro borrowed $250,000 to purchase a machine costing $300,000.He later borrowed an additional $25,000 using the machine as collateral.Both notes are nonrecourse.Eight years later, the machine has an adjusted basis of zero and two outstanding note balances of $145,000 and $18,000.Pedro sells the machine subject to the two liabilities for $45,000.What is his realized gain or loss?

A) $0

B) $45,000

C) $163,000

D) $208,000

E) None of the above

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A taxpayer who sells his or her principal residence at a realized loss can elect to recognize the loss even if a qualified residence is acquired during the statutory time period.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The basis of inherited property usually is its fair market value on the date of the decedent's death.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In a deductible casualty or theft, the basis of property involved is reduced by the amount of insurance proceeds received and by any resulting recognized loss.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kevin purchased 5,000 shares of Purple Corporation stock at $10 per share.Two years later, he receives a 5% common stock dividend.At that time, the common stock of Purple Corporation had a fair market value of $12.50 per share.What is the basis of the Purple Corporation stock, the per share basis, and gain recognized upon receipt of the common stock dividend?

A) $50,000 basis in stock, $10 basis per share for the original stock and $0 basis per share for the dividend shares, $0 recognized gain.

B) $50,000 basis in stock, $9.52 basis per share, $0 recognized gain.

C) $53,125 basis in stock, $10 basis per share for the original stock and $12.50 basis per share for the dividend shares, $3,125 recognized gain.

D) $53,125 basis in stock, $10.12 basis per share, $3,125 recognized gain.

E) None of the above.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Taylor inherited 100 acres of land on the death of his father in 2018.A Federal estate tax return was filed and this land was valued therein at $650,000, its fair market value at the date of the father's death.The father had originally acquired the land in 1972 for $112,000 and prior to his death he had expended $20,000 on permanent improvements.Determine Taylor's holding period for the land.

A) Will begin with the date his father acquired the property.

B) Will automatically be long-term.

C) Will begin with the date of his father's death.

D) Will begin with the date the property is distributed to him.

E) None of the above.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

In 1973, Fran received a birthday gift of stock worth $75,000 from her aunt.The aunt had owned the stock adjusted basis $50,000) for 10 years and paid gift tax of $27,000 on the transfer.Fran's basis in the stock is $75,000-the lesser of $77,000 $50,000 + $27,000) or $75,000.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is correct?

A) The gain basis for property received by gift is the lesser of the donor's adjusted basis or the fair market value on the date of the gift.

B) The loss basis for property received by gift is the same as the donor's basis.

C) The gain basis for inherited property is the same as the decedent's basis.

D) The loss basis for inherited property is the lesser of the decedent's basis or the fair market value on the date of the decedent's death.

E) None of the above.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ralph gives his daughter, Angela, stock basis of $8,000; fair market value of $6,000) .No gift tax results.If Angela subsequently sells the stock for $10,000, what is her recognized gain or loss?

A) $0

B) $2,000

C) $4,000

D) $10,000

E) None of the above

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Milt's building which houses his retail sporting goods store is destroyed by a flood.Sandra's warehouse which she is leasing to Milt to store the inventory of his business also is destroyed in the same flood.Both Milt and Sandra receive insurance proceeds that result in a realized gain.Sandra will have less flexibility than Milt in the type of building in which she can invest the proceeds and qualify for postponement treatment under § 1033 nonrecognition of gain from an involuntary conversion).

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The amount realized does not include any amount received by the taxpayer that is designated as severance damages by both the government and the taxpayer.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Wade is a salesman for a real estate development company.Because he is the "salesperson of the year," he is permitted to purchase a lot from the developer for $90,000.The fair market value of the lot is $150,000 and the developer's adjusted basis is $100,000.Wade must recognize a gain of $10,000 $100,000 developer's adjusted basis - $90,000 cost to Wade), and his adjusted basis for the lot is $100,000 $90,000 cost + $10,000 recognized gain).

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Leonore exchanges 5,000 shares of Pelican, Inc., stock for 2,000 shares of Blue Heron, Inc., stock.Leonore's adjusted basis for the Pelican stock is $300,000 and the fair market value of the Blue Heron stock is $350,000.Leonore's recognized gain is $0 and her adjusted basis for the Blue Heron stock is $300,000.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Lump-sum purchases of land and a building are allocated on the basis of the relative fair market values of the individual assets acquired.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 118

Related Exams