A) 16.28 percent

B) 15.81 percent

C) 15.57 percent

D) 16.33 percent

E) 15.88 percent

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A flexible short-term financial policy will tend to have more of which of the following than a restrictive short-term financial policy will? I.Uncollectable accounts receivable II.Work stoppages for lack of raw materials III.Carrying costs IV.Obsolete or out-of-date inventory

A) I and II only

B) III and IV only

C) II and III only

D) I, II, and III only

E) I, III, and IV only

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The accounts receivable turnover rate for Tough Pants Clothing has gone from an average of 12.6 times to 14.1 times per year.How has this change affected the firm's accounts receivable period?

A) Decrease of 1.98 days

B) Decrease of 3.08 days

C) Decrease of 3.28 days

D) Increase of 3.28 days

E) Increase of 3.08 days

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Corner Store Industries has annual sales of $662,070 and cost of goods sold of $494,160.The profit margin is 4.4 percent and the accounts payable period is 29 days.What is the average accounts payable balance?

A) $52,603

B) $55,488

C) $39,262

D) $40,616

E) $38,046

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which statement is true?

A) If a firm decreases its inventory period, its accounts receivable period will also decrease.

B) The longer the cash cycle, the more cash a firm typically has available to invest.

C) A firm would prefer a negative cash cycle over a positive cash cycle.

D) Decreasing the inventory period will automatically decrease the payables period.

E) Both the operating cycle and the cash cycle must be positive values.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kitchen and Laundry and More has annual credit sales of $2,473,701 and cost of goods sold of $1,838,207.The average accounts receivable balance is $56,736.How many days on average does it take the firm to collect its accounts receivable?

A) 8.94days

B) 9.27 days

C) 11.24 days

D) 10.47 days

E) 8.37 days

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kelso's has projected sales for January through April of $136,000, $148,000, $144,000, and $146,000, respectively.The firm collects 59 percent of sales in the month of sale, 36 percent in the month following the sale, and the remainder in the second month following the sale.Assume all sales are collected.The accounts receivable balance at the end of the beginning of January was $56,050 ($47,643 of which was uncollected December sales) .How much did the firm collect in the month of February?

A) $138,539

B) $141,220

C) $140,208

D) $138,615

E) $142,090

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following can occur if the operating cycle decreases while both the accounts receivable and the accounts payable periods remain constant?

A) Inventory period remains constant

B) Cash cycle increases

C) Inventory turnover rate increases

D) Accounts receivable turnover rate increases

E) Cash cycle remains constant

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

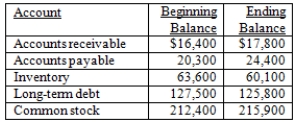

A company has the following account balances.Which statement is correct concerning these balances?

A) Accounts receivable is a $1,400 source of cash.

B) Common stock is a $3,500 use of cash.

C) Net working capital, excluding cash, is a $6,100 use of cash.

D) Long-term debt is a $1,700 source of cash.

E) Total debt is a $2,400 source of cash.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dover Wholesalers sells products exclusively to Benn Retailer.Benn Retailer buys exclusively from Dover Wholesalers.Dover Wholesalers has a receivables period of 44 days, an inventory period of 8 days, and a payables period of 63 days.Benn Retailer has an inventory period of 15 days, a receivables period of 22 days, and a payables period of 44 days.Which statement is correct given this information?

A) Dover Wholesalers has a shorter operating cycle than does Benn Retailer.

B) Benn Retailer has an operating cycle of 81 days.

C) It takes Benn Retailer less time to collect payment on a sale than it does for the firm to sell its inventory.

D) Dover Wholesalers is financing 100 percent of Benn Retailer's operating cycle.

E) Dover Wholesalers has a cash cycle of 11 days.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which statement is true?

A) The inventory period increases as the inventory turnover rate increases.

B) The length of the inventory period depends on the length of the cash cycle.

C) The inventory period is the average number of days a firm holds inventory on its shelves.

D) The inventory period is equal to the operating cycle minus the accounts payable period.

E) The inventory period has no effect on the cash cycle.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kurt's Music has a line of credit with a local bank that permits it to borrow up to $650,000 at any time.The interest rate is .64 percent per month.The bank charges compound interest and also requires that 2 percent of the amount borrowed be deposited into a non-interest-bearing account.How much interest will the firm pay if it needs $200,000 of cash for three months to pay its operating expenses?

A) $3,943.50

B) $3,949.21

C) $4,017.02

D) $3,864.63

E) $3,902.11

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The High Water Mark is operating at its optimal point.Which one of the following conditions exists given this firm's operating status?

A) Carrying costs exceed shortage costs

B) Carrying costs are equal to zero

C) Both carrying costs and shortage costs are at their minimum levels

D) Shortage costs are equal to zero

E) Shortage costs equal carrying costs

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following will increase the operating cycle?

A) Decreasing the accounts payable period

B) Increasing the accounts payable turnover rate

C) Increasing the cash cycle

D) Decreasing the accounts receivable turnover rate

E) Decreasing the inventory period

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Grain and Feed Store purchases are equal to 68 percent of the following quarter's sales.The accounts receivable period is 15 days and the accounts payable period is 30 days.Assume there are 30 days in each month.The store has estimated quarterly sales for the next year, starting with Quarter 1, of $16,750, $18,220, $17,560, and $19,710, respectively.How much will the store owe its suppliers at the end of Quarter 3?

A) $3,992.20

B) $3,807.40

C) $4,467.60

D) $4,508.10

E) $4,300.27

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following are inversely related to increases in a firm's current assets? I.Reorder costs II.Shortage costs III.Restocking costs IV.Carrying costs

A) I and III only

B) II and IV only

C) I, II, and III only

D) II, III, and IV only

E) I, III, and IV only

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Lumber Yard has projected sales for April through July of $152,400, $161,800, $189,700, and $196,400, respectively.The firm collects 52 percent of its sales in the month of sale, 46 percent in the month following the month of sale, and the remainder in the second month following the month of sale.What is the amount of the July collections?

A) $189,819

B) $181,508

C) $122,852

D) $175,500

E) $192,626

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of these activities is a source of cash?

A) Decreasing long-term debt

B) Increasing inventory

C) Repurchasing shares of stock

D) Increasing fixed assets

E) Decreasing accounts receivable

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An increase in the accounts receivable period is most apt to:

A) lengthen the accounts payable period.

B) shorten the inventory period.

C) shorten the operating cycle.

D) lengthen the cash cycle.

E) shorten the accounts payable period.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

French Vertical Systems has sales for the year of $425,860, cost of goods sold equal to 64 percent of sales, and an average inventory of $53,600.The profit margin is 6 percent and the tax rate is 21 percent.How many days on average does it take the firm to sell an inventory item?

A) 75.68 days

B) 81.46 days

C) 71.78 days

D) 78.74 days

E) 82.03 days

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 113

Related Exams