B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

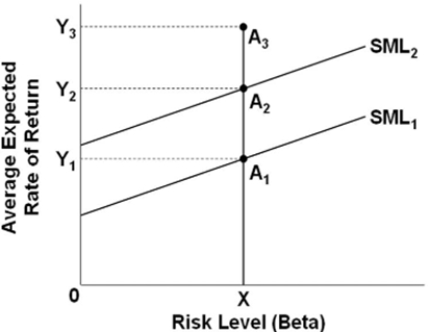

Refer to the graph. A movement of the Security Market Line from SML2 to SML1 and of the highlighted asset from A2 to A1 would be caused by

Refer to the graph. A movement of the Security Market Line from SML2 to SML1 and of the highlighted asset from A2 to A1 would be caused by

A) expansionary monetary policy and arbitrage, respectively.

B) arbitrage and expansionary monetary policy, respectively.

C) restrictive monetary policy and arbitrage, respectively.

D) arbitrage and restrictive monetary policy, respectively.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The average expected rate of return is a

A) volume-weighted average.

B) price-weighted average.

C) probability-weighted average.

D) value-weighted average.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rupert recently purchased a nonmaturing bond for $10,000 that pays $350 semiannual coupons.His expected rate of return per year on the bond is

A) 4 percent.

B) 7 percent.

C) 10 percent.

D) 12 percent.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

The Security Market Line is a straight line that plots how the average expected rates of return on assets and portfolios in an economy vary with their respective levels of nondiversifiable risk as measured by beta.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The compensation for bearing more risk in owning an asset is a higher rate of return for the asset.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Arbitrage occurs when

A) bond and stock rates of return equalize.

B) investors try to profit from selling a lower rate of return asset to buy one that is nearly identical but with a higher rate of return.

C) rates of return across all stocks equalize.

D) investors move from lower to higher rate of return assets, regardless of the comparability of the assets.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Arbitrage causes an equalization of the when assets are identical or nearly identical.

A) levels of risk of assets

B) rates of return of assets

C) time when payments are made from assets

D) prices of assets

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

(Consider This) According to critics, growth in the popularity of mutual funds has

A) significantly increased market risk for investors.

B) created more macroeconomic instability.

C) led corporate management and fund managers to focus more on short-run share prices than long-run investor returns.

D) discouraged average citizens from investing in stock and bond markets.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You estimate that a piece of real estate for investment will be worth $700,000 in five years.The current interest rate is 3 percent.What is the present value of this investment?

A) $604,000

B) $624,000

C) $680,000

D) $700,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The concept of time preference in financial investing rests on the belief that people

A) are indifferent between present and future consumption.

B) are patient.

C) are impatient.

D) intentionally consume 50 percent of assets in the present and 50 percent in the future.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

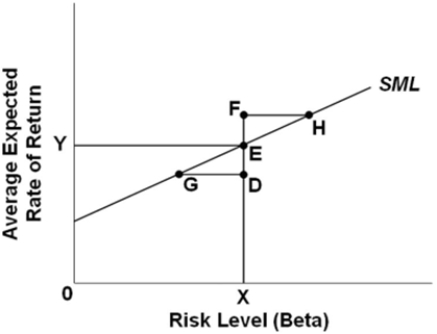

Refer to the graph.Each labeled point represents a different asset.For which of these assets would we expect arbitrage to cause movement to a different point?

Refer to the graph.Each labeled point represents a different asset.For which of these assets would we expect arbitrage to cause movement to a different point?

A) D and F

B) G and H

C) D, F, G and H

D) D, E, and F

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is true?

A) Asset prices and average expected rates of return are directly related, but levels of nondiversifiable risk and average expected rates of return are inversely related.

B) Asset prices and average expected rates of return are inversely related, but levels of nondiversifiable risk and average expected rates of return are directly related.

C) Asset prices, average expected rates of return, and levels of nondiversifiable risk are all directly related.

D) Average expected rates of return are inversely related to both asset prices and levels of nondiversifiable risk.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The beta for the market portfolio's level of nondiversifiable risk is

A) zero.

B) 1.

C) 100.

D) always fluctuating.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Financial investment refers to

A) the same idea as economic investment.

B) earning profits from producing goods and services.

C) purchasing or building an asset for monetary gain.

D) making new additions to the capital stock.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tracy won a $100 million jackpot. She can receive the jackpot as a $5 million payment each year for 20 years, or she can ask to receive the present value of all those payments all at once now. Assume an annual interest rate of 5 percent. If she decides to take the present value payment, about how much will she receive?

A) $52.1 million

B) $62.3 million

C) $71.4 million

D) $78.6 million

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Actively managed funds consistently outperform index funds.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The risk premium is the rate that compensates for risk.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A bond that is currently selling at $1,000 offers to pay $50 annually.What is the percentage rate of return on the bond?

A) 5 percent

B) 10 percent

C) 20 percent

D) 50 percent

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Bonds issued by the Federal government are riskier than bonds issued by corporations.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 323

Related Exams