B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using Image 18.2 Global Perspective, In October 2017, one Canadian dollar bought:

A) 50 U.S.dollars.

B) 0.80 U.S.dollars.

C) 2.60 U.S.dollars.

D) 17.8 U.S.dollars.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following are hypothetical exchange rates: 2 Swiss francs = 1 British pound and $1 = 2 British pound.We can conclude that:

A) $1 = 4 Swiss francs.

B) $1 = .5 Swiss francs.

C) 1 Swiss franc = $.50.

D) 1 Swiss franc = $2.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under a system of flexible exchange rates, an increase in the international value of a nation's currency will:

A) cause an international surplus of its currency.

B) contribute to disequilibrium in its balance of payments.

C) cause gold to flow into that country.

D) cause its imports to rise.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If Canada has full employment and the dollar dramatically depreciates in value, we can expect:

A) both our imports and our exports to rise.

B) both our imports and our exports to fall.

C) our exports to fall and our imports to increase.

D) inflation to occur.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following are hypothetical exchange rates: $1 = 140 yen; 1 Swiss franc = $.10.We conclude that:

A) 1 yen = 280 Swiss francs.

B) 1 yen = 14 Swiss francs.

C) 1 Swiss franc = 28 yen.

D) 1 Swiss franc = 14 yen.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

If a nation has a balance of payments deficit and exchange rates are flexible, the price of that nation's currency in the foreign exchange markets will rise.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The current account on a nation's balance of payments statement includes net investment income.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The export of capital is recorded as a credit on a nation's capital account in its balance of payments statement.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A nation's balance on the current account is equal to its exports less its imports of:

A) goods and services.

B) goods and services, minus Canadian purchases of assets abroad.

C) goods and services, plus net investment income and net transfers.

D) goods and services, plus foreign purchases of assets in Canada.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

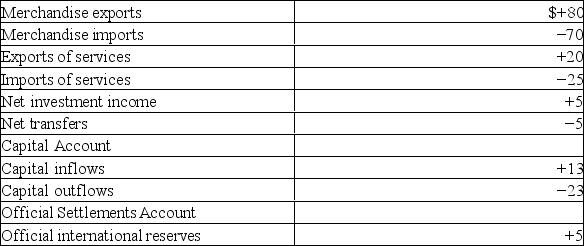

The following table shows the balance of payments statement for the hypothetical nation of Zabella in 2014.All the figures are in billions of dollars.  Refer to the above data.Given the scenario, it can be said that Zabella experienced a balance of payments:

Refer to the above data.Given the scenario, it can be said that Zabella experienced a balance of payments:

A) deficit of $5 billion in 2014.

B) surplus of $10 billion in 2014.

C) deficit of $10 billion in 2014.

D) surplus of $5 billion in 2014.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

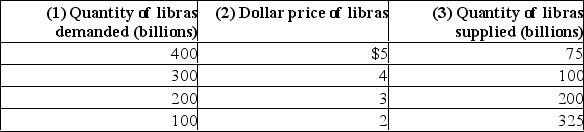

The following table shows the 2012 balance of payments data for the hypothetical nation of Zabella.All figures are in billions of dollars.Current Account:  Refer to the above data.Zabella's is experiencing a balance of trade:

Refer to the above data.Zabella's is experiencing a balance of trade:

A) deficit of $10 billion.

B) surplus of $5 billion.

C) surplus of $10 billion.

D) deficit of $5 billion.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Proponents of the managed floating exchange rate system argue that it has:

A) added the volatility needed by the exchange rate market.

B) been effective because it is a "non-system" without fixed rules.

C) been sufficiently flexible to weather major economic turbulence.

D) resolved major problems in balance of payments surpluses and deficits.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Exports cause:

A) an outflow of money and an inflow of goods and services.

B) an inflow of money and an inflow of goods and services.

C) an outflow of money and an outflow of goods and services.

D) an inflow of money and an outflow of goods and services.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under a system of flexible exchange rates a Canadian trade deficit with Mexico will tend to cause:

A) the Canadian government to ration pesos to Canadian importers.

B) a flow of gold from Canada to Mexico.

C) an increase in the peso price of dollars.

D) an increase in the dollar price of pesos.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under the managed floating exchange rate system, a government may be able to reduce the international value of its currency by:

A) selling its currency in the foreign exchange market.

B) buying its currency in the foreign exchange market.

C) selling foreign currencies in the foreign exchange market.

D) increasing its domestic interest rates.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

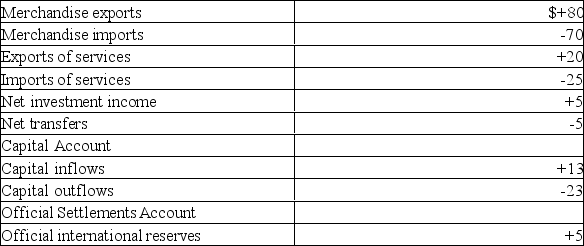

The following table indicates the dollar price of libras, the currency used in the hypothetical nation of Libra.Assume that a system of flexible exchange rates is in place.  Refer to the above table.The equilibrium dollar price of libras is:

Refer to the above table.The equilibrium dollar price of libras is:

A) $5

B) $4

C) $3

D) indeterminate.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

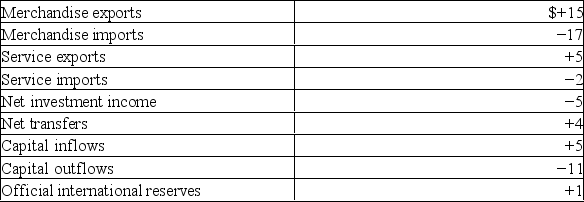

The following table shows the balance of payments statement of Transylvania for 2013.All the figures are in billions of dollars.  Refer to the above data.In 2013, Transylvania had a $2 billion balance of trade surplus.

Refer to the above data.In 2013, Transylvania had a $2 billion balance of trade surplus.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An increase in the dollar price of British pounds will:

A) increase the pound price of dollars.

B) lower the pound price of dollars.

C) leave the pound price of dollars unchanged.

D) cause Britain's terms of trade with the United States to deteriorate.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Using Image 18.2 Global Perspective, In October 2017, one Canadian dollars bought:

A) 2 Mexican pesos.

B) 9.23 Mexican pesos.

C) 25 Mexican pesos.

D) 15 Mexican pesos.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 101 - 120 of 133

Related Exams