A) $17.15

B) $11.00

C) $14.00

D) $12.50

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A fixed cost is a cost whose cost per unit varies as the activity level rises and falls.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

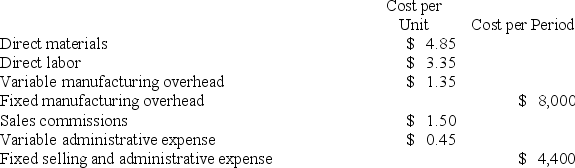

Lagle Corporation has provided the following information:  If 5,000 units are sold, the variable cost per unit sold is closest to:

If 5,000 units are sold, the variable cost per unit sold is closest to:

A) $14.60

B) $11.50

C) $9.55

D) $11.55

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

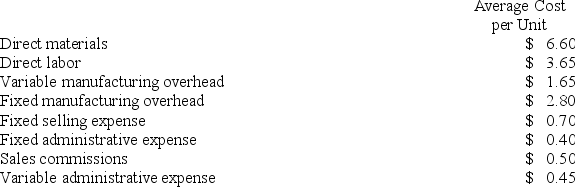

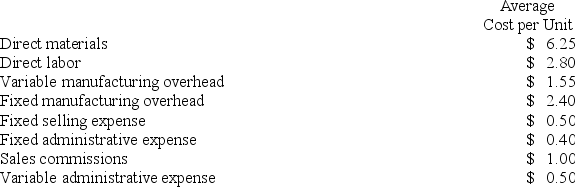

Barredo Corporation's relevant range of activity is 3,000 units to 7,000 units. When it produces and sells 5,000 units, its average costs per unit are as follows:  If 4,000 units are sold, the total variable cost is closest to:

If 4,000 units are sold, the total variable cost is closest to:

A) $67,000

B) $47,600

C) $51,400

D) $58,800

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Manufacturing overhead includes:

A) all direct material, direct labor and administrative costs.

B) all manufacturing costs except direct labor.

C) all manufacturing costs except direct labor and direct materials.

D) all selling and administrative costs.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dizzy Amusement Park is open from 8:00 am till midnight every day of the year. Dizzy charges its patrons a daily entrance fee of $30 per person which gives them unlimited access to all of the park's 35 rides. Dizzy gives out a free T-shirt to every 100th customer entering the park. The cost of this T-shirt would best be described as a:

A) fixed cost

B) mixed cost

C) step-variable cost

D) true variable cost

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

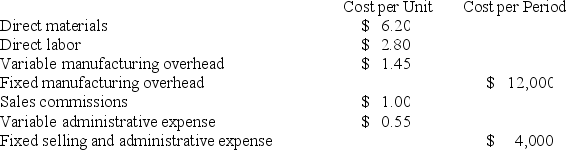

Wessner Corporation has provided the following information:  If 5,000 units are produced, the total amount of manufacturing overhead cost is closest to:

If 5,000 units are produced, the total amount of manufacturing overhead cost is closest to:

A) $18,000

B) $19,250

C) $18,625

D) $20,500

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

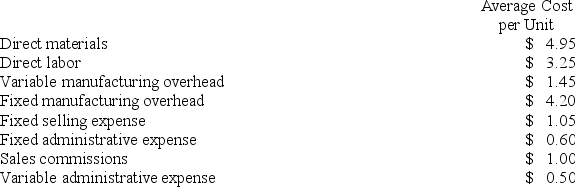

Macy Corporation's relevant range of activity is 4,000 units to 8,000 units. When it produces and sells 6,000 units, its average costs per unit are as follows:  If the selling price is $23.50 per unit, the contribution margin per unit sold is closest to:

If the selling price is $23.50 per unit, the contribution margin per unit sold is closest to:

A) $9.65

B) $6.50

C) $15.30

D) $12.35

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

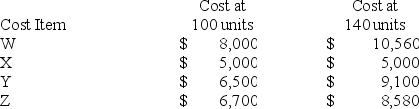

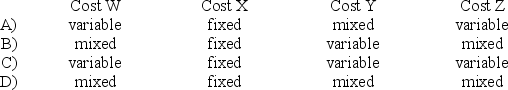

The following data have been collected for four different cost items.  Which of the following classifications of these cost items by cost behavior is correct?

Which of the following classifications of these cost items by cost behavior is correct?

A) Choice A

B) Choice B

C) Choice C

D) Choice D

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At an activity level of 9,000 machine-hours in a month, Moffatt Corporation's total variable maintenance cost is $390,240 and its total fixed maintenance cost is $368,280. What would be the total variable maintenance cost at an activity level of 9,300 machine-hours in a month? Assume that this level of activity is within the relevant range. (Round intermediate calculations to 2 decimal places.)

A) $758,520

B) $403,248

C) $390,240

D) $380,556

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following are examples of product costs except:

A) depreciation on the company's retail outlets.

B) salary of the plant manager.

C) insurance on the factory equipment.

D) rental costs of factory equipment.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Management of Mcgibboney Corporation has asked your help as an intern in preparing some key reports for November. Direct materials cost was $42,000, direct labor cost was $25,000, and manufacturing overhead was $62,000. Selling expense was $21,000 and administrative expense was $38,000. The prime cost for November was:

A) $79,000

B) $59,000

C) $67,000

D) $87,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The salary paid to the president of a company would be classified on the income statement as a(n) :

A) administrative expense.

B) direct labor cost.

C) manufacturing overhead cost.

D) selling expense.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

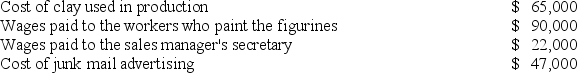

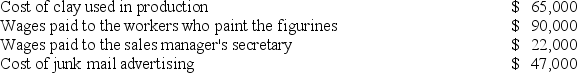

Vignana Corporation manufactures and sells hand-painted clay figurines of popular sports heroes. Shown below are some of the costs incurred by Vignana for last year:  What is the total of the product costs above?

What is the total of the product costs above?

A) $0

B) $69,000

C) $155,000

D) $159,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Adens Corporation's relevant range of activity is 2,000 units to 6,000 units. When it produces and sells 4,000 units, its average costs per unit are as follows:  If 5,000 units are sold, the variable cost per unit sold is closest to:

If 5,000 units are sold, the variable cost per unit sold is closest to:

A) $13.00

B) $10.60

C) $12.10

D) $15.40

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Gabel Inc. is a merchandising company. Last month the company's merchandise purchases totaled $63,000. The company's beginning merchandise inventory was $13,000 and its ending merchandise inventory was $15,000. What was the company's cost of goods sold for the month?

A) $91,000

B) $63,000

C) $65,000

D) $61,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Haack Inc. is a merchandising company. Last month the company's cost of goods sold was $84,000. The company's beginning merchandise inventory was $20,000 and its ending merchandise inventory was $18,000. What was the total amount of the company's merchandise purchases for the month?

A) $86,000

B) $82,000

C) $84,000

D) $122,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The cost of lubricants used to grease a production machine in a manufacturing company is an example of a(n) :

A) period cost.

B) direct material cost.

C) indirect material cost.

D) opportunity cost.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct in describing manufacturing overhead?

A) Manufacturing overhead when combined with direct materials cost forms conversion cost.

B) Manufacturing overhead consists of all manufacturing cost except for prime cost.

C) Manufacturing overhead is a period cost.

D) Manufacturing overhead when combined with direct labor cost forms prime cost.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Vignana Corporation manufactures and sells hand-painted clay figurines of popular sports heroes. Shown below are some of the costs incurred by Vignana for last year:  What is the total of the direct costs above?

What is the total of the direct costs above?

A) $65,000

B) $112,000

C) $155,000

D) $202,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 201 - 220 of 299

Related Exams