A) $88,000 and $44,000

B) $86,000 and $46,000

C) $84,000 and $48,000

D) $66,000 and $66,000![]()

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Federal income tax is levied on

A) a partnership based on its total net income when earned.

B) the partners for their individual shares of the reported partnership income.

C) the partners only when they withdraw earnings from the partnership for personal use.

D) the partnership at the end of the fiscal period.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The entry to record the investment of cash in a partnership by one partner would consist of a debit to

A) the partner's capital account and a credit to Cash.

B) Cash and a credit to an account called Partners' Equities.

C) Cash and a credit to the partner's capital account.

D) Cash and a credit to the partner's drawing account.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The Articles of Organization are the legal agreement of the partnership that specifies the names of partners,the name,location and nature of the partnership business;the starting date and life of the partnership as well as the rights and duties of each partner.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Partnership net income of $135,000 is to be divided between two partners,Ross Trane and Jane Winder,according to the following arrangement: There will be salary allowances of $40,000 for Trane and $50,000 for Winder,with the remainder divided one-third and two-thirds respectively per their partnership agreement.How much of the net income will be distributed to Trane and Winder,respectively?

A) $45,000 and $90,000

B) $30,000 and 15,000

C) $15,000 and $30,000

D) $55,000 and $80,000![]()

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Each partner is empowered to act as an agent for the partnership creating binding agreements no matter what the agreement concerns.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

When a partner makes a cash withdrawal that is intended to be a permanent reduction in his/her investment,the withdrawal account is debited.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kara Johnson and Tyler Jones are partners,and each has a capital balance of $100,000.To gain admission to the partnership,Raiden Nash pays $60,000 directly to Johnson for one-half of her equity.After the admission of Nash,the total partners' equity in the records of the partnership will be

A) $200,000.

B) $250,000.

C) $260,000.

D) $300,000.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Investments by a partner are credited to that partner's capital account.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Walters and Kim are partners.The partnership agreement provides for salary allowances of $26,000 for Walters and $22,000 for Kim and for interest of 10 percent on each partner's invested capital at the beginning of the year.The balance of any remaining profits or losses is to be divided 40 percent to Walters and 60 percent to Kim.On January 1,2016,the capital account balances were Walters,$75,000,and Kim,$95,000.Net income for the year was $72,000. 1.On page 10 of a general journal,record the following entries on December 31,2016.Omit descriptions. A)Record the salary allowances for the year. B)Record the interest allowances for the year. C)Record the division of the balance of net income. D)Close the drawing accounts into the capital accounts.Assume that the partners have withdrawn the full amount of their salaries. 2.Prepare a schedule showing the division of net income to the partners as it would appear on the income statement for 2016.

Correct Answer

verified

Correct Answer

verified

Essay

When dividing partnership net income,the consideration given to the amount of time a partner devotes to the business is called a salary ___________________.

Correct Answer

verified

Correct Answer

verified

True/False

A legal partnership does not exist unless there is a written partnership agreement.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

An association of two or more persons to carry on,as co-owners,a business for profit is called a(n)___________________.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) If partners consider their cash withdrawals to be compensation for the work they do for the partnership,the amounts of the withdrawals should be charged to Salaries Expense.

B) If there is no specific agreement on the division of partnership profits and losses,they are divided equally among the partners.

C) If a salary is allowed to one partner,other partners also must receive a salary allowance.

D) None of these statements are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The journal entry to record the division of a partnership profit consists of a debit to each partner's capital account and a credit to Cash.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Limited partners are only liable for their investment in the partnership and are therefore prohibited from having their names in the partnership's name.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

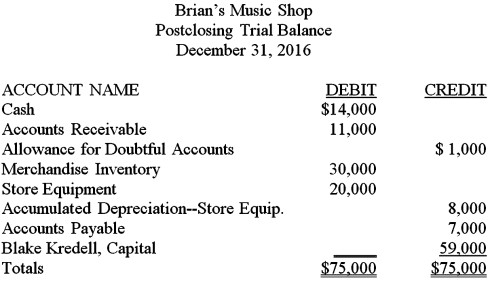

Brian McCarthy owns and operates a business called Brian's Music Shop.His postclosing trial balance on December 31,2016,is provided below.Brian plans to enter into a partnership with Emma Jones,effective January 1,2017.Profits and losses will be shared equally.Brian will transfer all assets and liabilities of his shop to the partnership,after revaluation.Emma will invest cash equal to Brian's investment after revaluation.The agreed values are: Accounts Receivable (net),$10,000;Merchandise Inventory,$35,000;and Store Equipment,$15,000.

The partnership will operate under the name Beautiful Music.

Record each partner's investment on page 1 of a general journal.Omit descriptions.

Prepare a balance sheet for Beautiful Music just after the investments.

Correct Answer

verified

Correct Answer

verified

True/False

It is customary for a partnership's income statement to show the division of net income or loss for the year between the partners.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

If plant and equipment are transferred from a sole proprietorship to a partnership,the Accumulated Depreciation accounts start with ____________________ balances in the partnership records.

Correct Answer

verified

Correct Answer

verified

Essay

If a partnership's net income is in excess of the salary and interest allowances,the entry to close Income Summary after the allowances are recorded will include a(n)____________________ to Income Summary.

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 106

Related Exams