A) an asset.

B) an addition to the Common Stock and Preferred Stock accounts in the Stockholders' Equity section.

C) a deduction from the Retained Earnings in the Stockholders' Equity section.

D) a deduction from the sum of all other items in the Stockholders' Equity section.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

When a corporation purchases its own stock and intends to reissue that stock at a later date,the cost of the shares is shown in the Assets section of the balance sheet until the stock is reissued.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Retained earnings do not represent a cash fund.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Total stockholders' equity would be decreased by

A) a stock split.

B) an appropriation of retained earnings.

C) a cash dividend.

D) a stock dividend.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Corporations are subject to the same tax filing deadlines as individual taxpayers.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The entry to record the declaration of a stock split includes a debit to Retained Earnings.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An appropriation of retained earnings represents

A) cash set aside for some designated purpose.

B) a portion of retained earnings that is currently unavailable for dividends.

C) a current liability of the corporation.

D) a current asset of the corporation.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be found on a corporation's income statement?

A) Retained Earnings

B) Income Tax Expense

C) Organization Costs

D) Dividends Payable

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the corporation's income tax computed at the end of the year is less than the total of quarterly deposits,the necessary adjustment will result in a

A) debit to Income Tax Expense.

B) credit to Income Tax Payable.

C) debit to Income Tax Refund Receivable.

D) credit to Income Tax Refund Receivable.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The record date is the date

A) on which the board of directors declares the dividend.

B) used to determine who will receive the dividend.

C) on which the dividend is paid.

D) on which the dividend transaction is recorded in the general journal.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Essay

A corporation reported a net income of $200,000 for its fiscal year and declared and paid cash dividends of $90,000.A stock dividend recorded at $50,000 was also distributed during the year.If the ending balance of the Retained Earnings account was $300,000,calculate the beginning balance in the Retained Earnings account.

Correct Answer

verified

Correct Answer

verified

True/False

Deferred Tax Assets are created whenever taxes are paid on revenue transactions that will be reflected in future financial statement income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) The Common Stock Dividends Distributable account is shown as a current liability on the balance sheet.

B) When a stock dividend is distributed,no assets leave or enter the corporation.

C) When a stock dividend is declared,the total amount debited to Retained Earnings is the par value,or stated value,of the shares to be issued.

D) When a stock dividend is declared,the total amount of the dividend is debited to the Common Stock account.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Essay

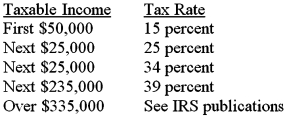

After all revenue and expense accounts,other than Income Tax Expense,have been extended to the Income Statement section of the worksheet of Carlton Corporation,the net income is determined to be $75,000.Using the following corporate income tax rates,compute the corporation's federal income taxes payable.(Assume that the firm's taxable income is the same as its income for financial accounting purposes. )

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporation reported a net income of $120,000 for its fiscal year and declared and paid cash dividends of $50,000.A stock dividend recorded at $80,000 was also distributed during the year.If the beginning balance of the Retained Earnings account was $200,000,the ending balance is

A) $170,000.

B) $190,000.

C) $200,000.

D) $270,000.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Essay

A corporation has paid estimated income taxes of $59,000 during the year 2016.At the end of the year,the corporation's tax bill is computed to be $70,000.Record the entry to adjust the Income Tax Expense account on page 6 of a general journal.Omit the description.

Correct Answer

verified

Correct Answer

verified

True/False

The entry to record the payment of a cash dividend includes a debit to Retained Earnings and a credit to Cash.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is not correct?

A) The entry to record the appropriation of retained earnings for warehouse construction includes a debit to Retained Earnings.

B) Appropriated retained earnings are listed separately on the balance sheet.

C) When retained earnings are appropriated,cash is set aside for a specific purpose.

D) Dividends cannot be declared from appropriated retained earnings.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Essay

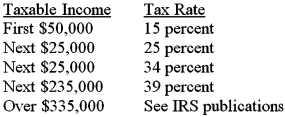

After all revenue and expense accounts,other than Income Tax Expense,have been extended to the Income Statement section of the worksheet of Folk Enterprises,Inc. ,the net income is determined to be $300,000.Using the following corporate income tax rates,compute the corporation's federal income taxes payable.(Assume that the firm's taxable income is the same as its income for financial accounting purposes. )

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the cumulative taxable income is higher than that reported on the financial statements,this gives rise to

A) a deferred income tax liability.

B) a deferred income tax asset.

C) Either of these.

D) Neither of these.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 99

Related Exams