A) Financial leverage.

B) Discount on stock.

C) Premium on stock.

D) Preemptive right.

E) Capital gain.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Essay

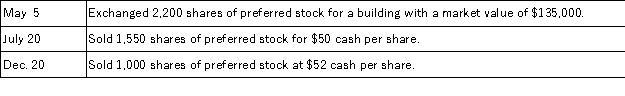

Boron Company is authorized to issue 50,000 shares of $50 par value,8%,cumulative,fully participating preferred stock,and 750,000 shares of $5 par value common stock.Prepare journal entries to record the following selected transactions that occurred during the company's first year of operations:

Correct Answer

verified

Correct Answer

verified

Essay

A stock _________________ keeps stockholder records and prepares official lists of stockholders for stockholder meetings and dividend payments.

Correct Answer

verified

Correct Answer

verified

True/False

Special rights often granted to preferred stock include a preference for receiving dividends and additional voting privileges.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Alto Company issued 7% preferred stock with a $100 par value.This means that:

A) Preferred shareholders have a guaranteed dividend.

B) The amount of the potential dividend is $7 per year per preferred share.

C) Preferred shareholders are entitled to 7% of the annual income.

D) The market price per share will approximate $100 per share.

E) Only 7% of the total paid-in capital can be preferred stock.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Changes in retained earnings are commonly reported in the:

A) Statement of cash flows.

B) Balance sheet.

C) Statement of stockholders' equity.

D) Multiple-step income statement.

E) Single-step income statement.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Essay

The total amount of cash and other assets the corporation receives from its stockholders in exchange for common stock is called __________________________.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ultimate Sportswear has $100,000 of 8% noncumulative,nonparticipating,preferred stock outstanding.Ultimate Sportswear also has $500,000 of common stock outstanding.In the company's first year of operation,no dividends were paid.During the second year,the company paid cash dividends of $30,000.This dividend should be distributed as follows:

A) $8,000 preferred;$22,000 common.

B) $16,000 preferred;$14,000 common.

C) $7,500 preferred;$22,500 common.

D) $15,000 preferred;$15,000 common.

E) $0 preferred;$30,000 common.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The amount of annual cash dividends distributed to common shareholders relative to the common stock's market value is the:

A) Dividend payout ratio.

B) Dividend yield.

C) Price-earnings ratio.

D) Current yield.

E) Earnings per share.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Stocks that pay relatively large cash dividends on a regular basis are called:

A) Small capital stocks.

B) Mid capital stocks.

C) Growth stocks.

D) Large capital stocks.

E) Income stocks.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Stocks with a price-earnings ratio less than 20 to 25 are likely to be overpriced.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Corporations avoid many of the state regulations and controls that proprietorships and partnerships are subject to.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Record the following transactions of Naches Corporation in general journal form: (a)Reacquired 8,000 of its own $3 par value common stock at $20 cash per share.The stock was originally issued at $15 per share. (b)Sold 2,000 shares of the stock reacquired under part (a)at $23 cash per share. (c)Sold 3,000 shares of the stock reacquired under part (a)at $19 cash per share.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company made an error in calculating and reporting amortization expense in 2015.The error was discovered in 2016.The item should be reported as a prior period adjustment:

A) on the 2015 statement of retained earnings.

B) on the 2015 income statement.

C) on the 2016 statement of retained earnings.

D) on the 2016 income statement.

E) accounted for with a cumulative "catch-up" adjustment in 2016.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Callable preferred stock gives a corporation the option of exchanging preferred shares into common shares at a specified rate.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Torino Company has 10,000 shares of $5 par value,4% cumulative and nonparticipating preferred stock and 100,000 shares of $10 par value common stock outstanding.The company paid total cash dividends of $1,000 in its first year of operation.The cash dividend that must be paid to preferred stockholders in the second year before any dividend is paid to common stockholders is:

A) $1,000.

B) $2,000.

C) $3,000.

D) $4,000.

E) $0.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If a company resells treasury stock below the acquisition cost,a loss from the sale of treasury stock is recorded.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A reverse stock split increases the market value per share and the par value per share of stock.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company had a beginning balance in retained earnings of $430,000.It had net income of $60,000 and paid out cash dividends of $56,250 in the current period.The ending balance in retained earnings equals:

A) $546,250.

B) $426,250.

C) $116,250.

D) $433,750.

E) $490,000.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company's board of directors votes to declare a cash dividend of $1.00 per share on its 12,000 common shares outstanding.The journal entry to record the payment of the cash dividend is:

A) Debit Dividend Expense $12,000;credit Cash $12,000.

B) Debit Dividend Expense $12,000;credit Common Dividend Payable $12,000.

C) Debit Common Dividend Payable $12,000;credit Cash $12,000.

D) Debit Retained Earnings $12,000;credit Common Dividend Payable $12,000.

E) Debit Common Dividend Payable $12,000;credit Retained Earnings $12,000.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 205

Related Exams