A) $22.50

B) $25.00

C) $23.68

D) $26.32

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a company uses a predetermined overhead rate,which of the following statements is correct?

A) Manufacturing Overhead will be debited for estimated overhead

B) Manufacturing Overhead will be credited for estimated overhead

C) Manufacturing Overhead will be debited for actual overhead

D) Manufacturing Overhead will be credited for actual overhead

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be used to record the labor cost that is not traceable to a specific job?

A) Raw Materials Inventory would be debited

B) Work in Process Inventory would be debited

C) Manufacturing Overhead would be debited

D) Manufacturing Overhead would be credited

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Manufacturing overhead was estimated to be $200,000 for the year along with 20,000 direct labor hours.Actual manufacturing overhead was $215,000,and actual labor hours were 21,000.To dispose of the balance in the Manufacturing Overhead account,which of the following would be correct?

A) Cost of Goods Sold would be credited for $15,000

B) Cost of Goods Sold would be credited for $5,000

C) Cost of Goods Sold would be debited for $5,000

D) Cost of Goods Sold would be debited for $15,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Manufacturing overhead was estimated to be $500,000 for the year along with 20,000 direct labor hours.Actual manufacturing overhead was $450,000,actual direct labor hours were 19,000.The amount of manufacturing overhead applied to production would be

A) $500,000

B) $450,000

C) $427,500

D) $475,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Manufacturing overhead was estimated to be $200,000 for the year along with 20,000 direct labor hours.Actual manufacturing overhead was $215,000,actual labor hours were 21,000.The predetermined overhead rate would be

A) $10.00

B) $1.05

C) $10.75

D) $10.24

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

To eliminate underapplied overhead at the end of the year,Manufacturing Overhead would be credited and Cost of Goods Sold would be debited.If manufacturing overhead is underapplied during the year,Manufacturing Overhead will need to be credited to bring the account balance to zero,while Cost of Goods Sold would be debited.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In a service firm,the cost associated with time that employees spend on training,paperwork,and supervision is considered part of manufacturing overhead.Service firms incur many indirect costs that cannot be traced to specific clients or accounts.Examples include the nonbillable time that employees spend on training,paperwork,and supervision.These indirect costs are treated just like manufacturing overhead in a factory.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be used to record the property taxes on a factory building?

A) Raw Materials Inventory would be debited

B) Work in Process Inventory would be debited

C) Manufacturing Overhead would be debited

D) Manufacturing Overhead would be credited

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be used to apply manufacturing overhead to production for the period?

A) Raw Materials Inventory would be debited

B) Work in Process Inventory would be debited

C) Manufacturing Overhead would be debited

D) Work in Process Inventory would be credited

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following accounts is not affected by applied manufacturing overhead?

A) Raw Materials Inventory

B) Work in Process Inventory

C) Finished Goods Inventory

D) Cost of Goods Sold

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A predetermined overhead rate is calculated using which formula?

A) Actual manufacturing overhead cost/estimated units in the allocation base

B) Estimated units in the allocation base/estimated manufacturing overhead cost

C) Estimated manufacturing overhead cost/actual units in the allocation base

D) Estimated manufacturing overhead cost/estimated units in the allocation base

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is incorrect regarding service firms?

A) Each client or account is equivalent to a process in a process costing firm.

B) The accounting system will track the time and resources spent serving a specific client or account.

C) Managers of service firms need cost information to price their services,to budget and control costs,and to determine the profitability of different types of clients.

D) The primary driver used to assign costs is billable hours.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When manufacturing overhead is applied to production,which of the following accounts is credited?

A) Raw Materials Inventory

B) Work in Process Inventory

C) Finished Goods Inventory

D) Manufacturing Overhead

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A job cost sheet will record the direct materials and direct labor used by the job but not the manufacturing overhead applied.A job cost sheet summarizes all of the costs incurred on a specific job.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

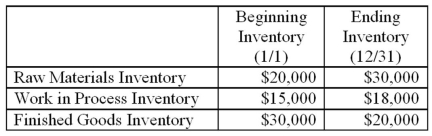

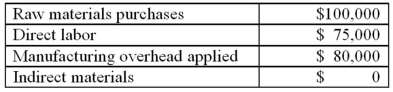

McGown Corp has the following information: Additional information for the year is as follows:

Compute the cost of goods manufactured.

A) $248,000

B) $242,000

C) $265,000

D) $235,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When materials are placed into production,

A) Raw Materials Inventory is debited if the materials are traced directly to the job.

B) Work in Process Inventory is debited if the materials are traced directly to the job.

C) Manufacturing Overhead is debited if the materials are traced directly to the job.

D) Raw Materials Inventory is credited only if the materials are traced directly to the job,otherwise manufacturing overhead is crediteD.When direct materials are placed into production,the cost is transferred from Raw Materials Inventory with a credit,and debited to Work in Process Inventory.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

If there is a debit balance in the Manufacturing Overhead account at the end of the period,overhead was underapplied.If there is a debit balance in the Manufacturing Overhead account at the end of the period,actual is greater than applied overhead,so overhead was underapplied.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When disposed of,underapplied manufacturing overhead will

A) increase Cost of Goods Sold.

B) increase Finished Goods.

C) decrease Cost of Goods Sold.

D) decrease Finished Goods.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be used to record the labor cost that is traceable to a specific job?

A) Raw Materials Inventory would be debited

B) Work in Process Inventory would be debited

C) Manufacturing Overhead would be debited

D) Manufacturing Overhead would be credited

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 112

Related Exams