A) Mutually exclusive projects.

B) Screening projects.

C) Independent projects.

D) Preference projects.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Addison Corp is considering the purchase of a new piece of equipment.The equipment will have an initial cost of $900,000,a 6 year life,and no salvage value.If the accounting rate of return for the project is 5%,what is the annual increase in net cash flow? Ignore income taxes.

A) $45,000

B) $105,000

C) $150,000

D) $195,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The payback period is defined as the average net income divided by the initial investment.The payback period is the initial investment divided by the annual net cash flow,if cash flows are equal each year.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Newport Corp is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in cash flow of $200,000.The equipment will have an initial cost of $900,000 and have a 6 year life.There is no salvage value for the equipment.What is the payback period?

A) 1.33 years

B) 2.57 years

C) 4.50 years

D) 6.00 years

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fletcher Corp is considering the purchase of a new piece of equipment.The equipment will have an initial cost of $400,000,a 5 year life,and a salvage value of $75,000.If the accounting rate of return for the project is 10%,what is the annual increase in net cash flow? Ignore income taxes.

A) $25,000

B) $40,000

C) $65,000

D) $105,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

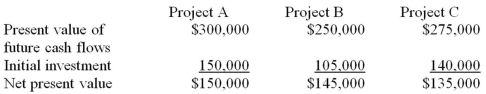

Carol,Inc.is considering three different independent investment opportunities.The present value of future cash flows,initial investment,and net present value for each of the projects are as follows: In what order should Carol prioritize investment in the projects?

A) A,C,B

B) B,C,A

C) A,B,C

D) B,A,C

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A problem in which you must calculate how much money you will have in the future as a result of depositing a fixed amount of money each period is a

A) future value of a single amount problem.

B) present value of a single amount problem.

C) future value of an annuity problem.

D) present value of an annuity problem.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

To find the present value of a single amount,you only need to know the amount to be received in the future,the interest rate and the number of periods until the amount will be received.With these three elements you can compute present value.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A decision that occurs when managers evaluate a proposed capital investment to determine whether it meets some minimum criteria is a(n)

A) preference decision.

B) capital decision.

C) screening decision.

D) incremental analysis.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When comparing mutually exclusive capital investments,managers should

A) choose the option with the lowest cost on a net present value basis.

B) choose the option with the lowest undiscounted cost.

C) not use net present value because it cannot be used to compare investments.

D) not use sensitivity analysis.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dallas Corp is trying to decide whether to lease or purchase a piece of equipment needed for the next five years.The equipment would cost $100,000 to purchase,and maintenance costs would be $10,000 per year.After five years,Dallas estimates it could sell the equipment for $30,000.If Dallas leased the equipment,it would pay a set annual fee that would include all maintenance costs.Dallas has determined after a net present value analysis that at its hurdle rate of 12%,it would be better off by $11,000 if it leases the equipment.What would the approximate annual cost be if Dallas were to lease the equipment?

A) $21,800

B) $27,800

C) $30,000

D) $34,700

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The method that compares the present value of a project's future cash flows to the initial investment is

A) Accounting rate of return.

B) Payback period.

C) Net present value.

D) Internal rate of return.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Independent projects are unrelated to one another,so that investing in one project does not affect the choice about investing in another project.This is the definition of an independent project.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Wilson Corp is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in net income after tax of $50,000.The equipment will have an initial cost of $600,000 and have an 8 year life.The salvage value of the equipment is estimated to be $100,000.If the hurdle rate is 10%,what is the internal rate of return?

A) less than zero

B) between zero and 10%

C) between 10% and 15%

D) more than 15%

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Homer Corp is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in net income after tax of $100,000.The equipment will have an initial cost of $400,000 and have a 5 year life.If the salvage value of the equipment is estimated to be $75,000,what is the annual net cash flow?

A) $25,000

B) $35,000

C) $165,000

D) $175,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An analysis that reveals whether changing the underlying assumptions would affect the decision is a

A) net present value analysis.

B) internal rate of return analysis.

C) payback period analysis.

D) sensitivity analysis.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Olive Corp is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in cash flow of $250,000.The equipment will have an initial cost of $1,300,000 and have an 8 year life.There is no salvage value for the equipment.If the hurdle rate is 10%,what is the internal rate of return? Ignore income taxes.

A) between 6% and 8%

B) between 8% and 10%

C) between 10% and 12%

D) less than zero

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

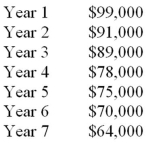

Patterson Corp is considering the purchase of a new piece of equipment,which would have an initial cost of $500,000,a 7 year life,and $150,000 salvage value.The increase in net income each year of the equipment's life would be as follows: What is the payback period?

A) 3.55 years

B) 3.82 years

C) 5.97 years

D) 6.18 years

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Heidi Inc.is considering whether to lease or purchase a piece of equipment.The total cost to lease the equipment will be $120,000 over its estimated life,while the total cost to buy the equipment will be $75,000 over its estimated life.At Heidi's required rate of return,the net present value of the cost of leasing the equipment is $73,700 and the net present value of the cost of buying the equipment is $68,000.Based on financial factors,Heidi should

A) lease the equipment,saving $45,000 over buying.

B) buy the equipment,saving $45,000 over leasing.

C) lease the equipment,saving $5,700 over buying.

D) buy the equipment,saving $5,700 over leasing.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You purchase a home for $200,000 that you expect to appreciate 6% in value on an annual basis.How much will the home be worth in ten years?

A) $111,680

B) $358,120

C) $1,472,020

D) $2,636,160

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 100

Related Exams