A) Money supply falls by $100,000.

B) Money supply falls by $1,000,000.

C) Money supply rises by $10,000.

D) Money supply rises by $1,000,000.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Fed conducts an open market purchase of $10 million in government securities. If the reserve ratio is 20%, what is the maximum change in the money supply? Assume banks hold no excess reserves and there is no currency withdrawal from the banking system.

A) maximum increase in money supply = $10 million

B) maximum decrease in money supply = $10 million

C) maximum increase in money supply = $50 million

D) maximum decrease in money supply = $50 million

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The unit-of-account function of money means that money is used

A) as a consistent means of measuring the value of things.

B) as the common denominator of future payments.

C) to pay for goods and services.

D) to accumulate purchasing power.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the federal penitentiary at Lompoc, California, inmates used packages of mackerel to buy items such as haircuts at the prison barber shop and laundry services. What function do these packages of mackerel serve?

A) They functioned as money.

B) They served as a corruption deterrent.

C) They enabled prison officers to monitor illegal money flows.

D) They forced prisoners to engage in barter.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The discount rate is the rate of interest charged when banks lend excess reserves to one another.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

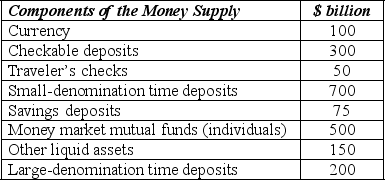

Table 9-1

-Refer to Table 9-1. The difference between M1 and M2 amounts to

-Refer to Table 9-1. The difference between M1 and M2 amounts to

A) $325 billion.

B) $350 billion.

C) $450 billion.

D) $1,275 billion.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

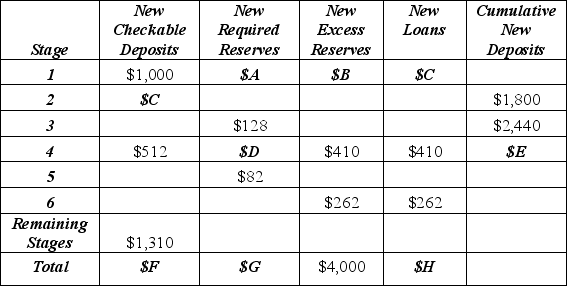

Table 9-6: Deposit Expansion Stages

In Table 9-6, assume that banks loan out 100% of their excess banking reserves, there are no cash withdrawals, and all loan proceeds are spent. Figures have been rounded up to the nearest whole number.

-Refer to Table 9-6. What is the value of $A in stage 1?

In Table 9-6, assume that banks loan out 100% of their excess banking reserves, there are no cash withdrawals, and all loan proceeds are spent. Figures have been rounded up to the nearest whole number.

-Refer to Table 9-6. What is the value of $A in stage 1?

A) $100

B) $200

C) $600

D) $800

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

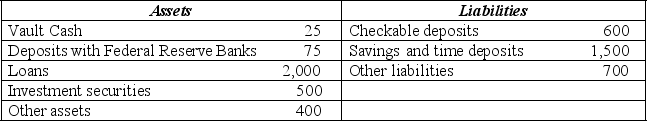

Table 9-3

Balance Sheet of the Alpha-Beta Bank

(All figures in $ million)

-Refer to Table 9-3. If the required reserve ratio is 10%, what is the amount of excess reserves held by Alpha-Beta Bank?

-Refer to Table 9-3. If the required reserve ratio is 10%, what is the amount of excess reserves held by Alpha-Beta Bank?

A) $25 million

B) $40 million

C) $60 million

D) $75 million

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the Fed increases the discount rate, it is pursuing

A) a contractionary policy because it will be more costly for banks to borrow funds and this puts upward pressure on interest rates in the economy.

B) a contractionary policy because it reduces banks' profit margins by raising the cost of borrowing and lowering the return on lending.

C) an expansionary policy because it raises the cost of holding excess reserves in the banking system.

D) an expansionary policy because it increases bank profits by putting upward pressure on the interest rates that banks can charge on its loans.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the banking system today, the reserves banks hold against their deposit liabilities must take one of two forms. They are

A) vault cash and deposits at the Fed.

B) vault cash and checkable deposits.

C) currency in circulation and checkable deposits.

D) gold and vault cash.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Inmates at the federal penitentiary at Lompoc, California, accepted packages of mackerel in exchange for goods and services. What function do these packages of mackerel perform?

A) They function as a store of value.

B) They function as a medium of exchange.

C) They function as a unit of account.

D) They function as a factor of production.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

To reduce the political influence on the Board of Governors,

A) the president of the United States appoints a new board every four years.

B) the reelection campaign for each member is less than one year.

C) each member is appointed for 7 years, with one term expiring every year.

D) each member is appointed for 14 years, with one term expiring every two years.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The seven members of the Board of Governors serve 14-year terms to

A) provide steady employment.

B) reduce political influence.

C) prevent illegal appointments.

D) inhibit independent decisions.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

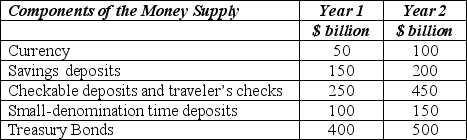

Table 9-2

-Refer to Table 9-2. In Year 1, the supply of money measured by M1 was

-Refer to Table 9-2. In Year 1, the supply of money measured by M1 was

A) $150 billion.

B) $300 billion.

C) $450 billion.

D) $950 billion.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is true regarding the reserve requirements?

A) The Fed changes them frequently because they are a power monetary policy tool.

B) The Fed does not change them much at all because taxation is a more impactful monetary policy tool.

C) The Fed changes them frequently because doing so simplifies banking operations.

D) The Fed does not change them much at all because doing so would make banking operations difficult.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nita deposits a check for $750 drawn against Home Federal Bank into her account at Village Bank. Which pair of the T-accounts below shows this transaction on the respective bank's balance sheets?

A) ![]()

B) ![]()

C) ![]()

D) ![]()

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the reserve ratio is 25% and banks do not hold excess reserves. When the Fed sells $40 million of bonds to the public,

A) bank reserves increase by $40 million and money supply could increase by a maximum of $40 million.

B) bank reserves increase by $40 million and money supply could increase by a maximum of $160 million.

C) bank reserves decrease by $40 million and money supply could decrease by a maximum of $40 million.

D) bank reserves decrease by $40 million and money supply could decrease by a maximum of $160 million.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Increasing the reserve requirement ratio is

A) a contractionary policy because it lowers the amount of total reserves in the banking system.

B) a contractionary policy because it lowers the amount of excess reserves in the banking system.

C) an expansionary policy because it raises the amount of excess reserves in the banking system.

D) an expansionary policy because it raises the amount of required reserves in the banking system.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following illustrates the store-of-value function of money?

A) writing a check to buy a new Volkswagen

B) noting that the price of a $20,000 Volkswagen is 16,000 euros

C) agreeing to repay a bank $400 a month for the next 48 months for a loan to buy a new Volkswagen

D) keeping $20,000 in cash in your mattress instead of buying a new Volkswagen

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Scenario 2: Fed sells bonds to Henry Hyde Consider a banking system in which the reserve requirement is 10%, banks try not to hold excess reserves, consumers and firms hold money only in the form of checking account balances, and all loan proceeds are spent. Suppose initially all banks in the system are loaned up. Now, suppose that the Fed sells a $50,000 bond to Henry Hyde, who pays for the bond by writing a check drawn against Jekyll Bank. -Refer to Scenario 2. To collect the $50,000 payment made by Henry, the Fed

A) adds $50,000 to Jekyll Bank's reserves by $50,000.

B) subtracts $50,000 from Jekyll Bank's reserves.

C) accepts the cash from Jekyll Bank which acts on behalf of Henry Hyde.

D) collects $5,000 (the required reserve portion) from Jekyll Bank.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 224

Related Exams